KlickEx sought to revolutionize cross-border payments in the Pacific region by creating an accessible, user-friendly platform.

The primary goal was to develop a solution that would make money transfers and mobile top-ups seamless for Pacific Island communities, while ensuring compliance with financial regulations and maintaining high security standards.

Our role

Our role went beyond simple development – we became strategic partners in achieving KlickEx’s business objectives. Our team conducted extensive research of Pacific financial markets and user behaviors to create a solution that precisely matched regional needs.

Working closely with KlickEx stakeholders, we:

- Created an intuitive interface that decreased transaction completion time

- Implemented multi-currency support handling complex exchange rates and fee structures

- Integrated multiple payment systems and mobile wallet providers across the Pacific region

The resulting platform not only met the technical requirements but delivered exceptional business outcome – reaching 53,000 users with steady monthly growth of 3,000 new users (5.6% MoM). This success expanded our market reach across Pacific Island communities.

Through detailed analysis of Pacific financial markets and user behaviors, we developed a strategic foundation for KlickEx’s money transfer platform. Our research focused on three key phases:

- Evaluated the existing platform to identify improvement opportunities, focusing on user flows and regional banking patterns.

- Conducted SWOT analysis of leading money transfer platforms to identify market opportunities and potential challenges.

- Created a simplified structure with mobile-first design principles, ensuring accessibility for users of all technical backgrounds.

Stages

- UX audit

- Competitors analysis

- Informational architecture

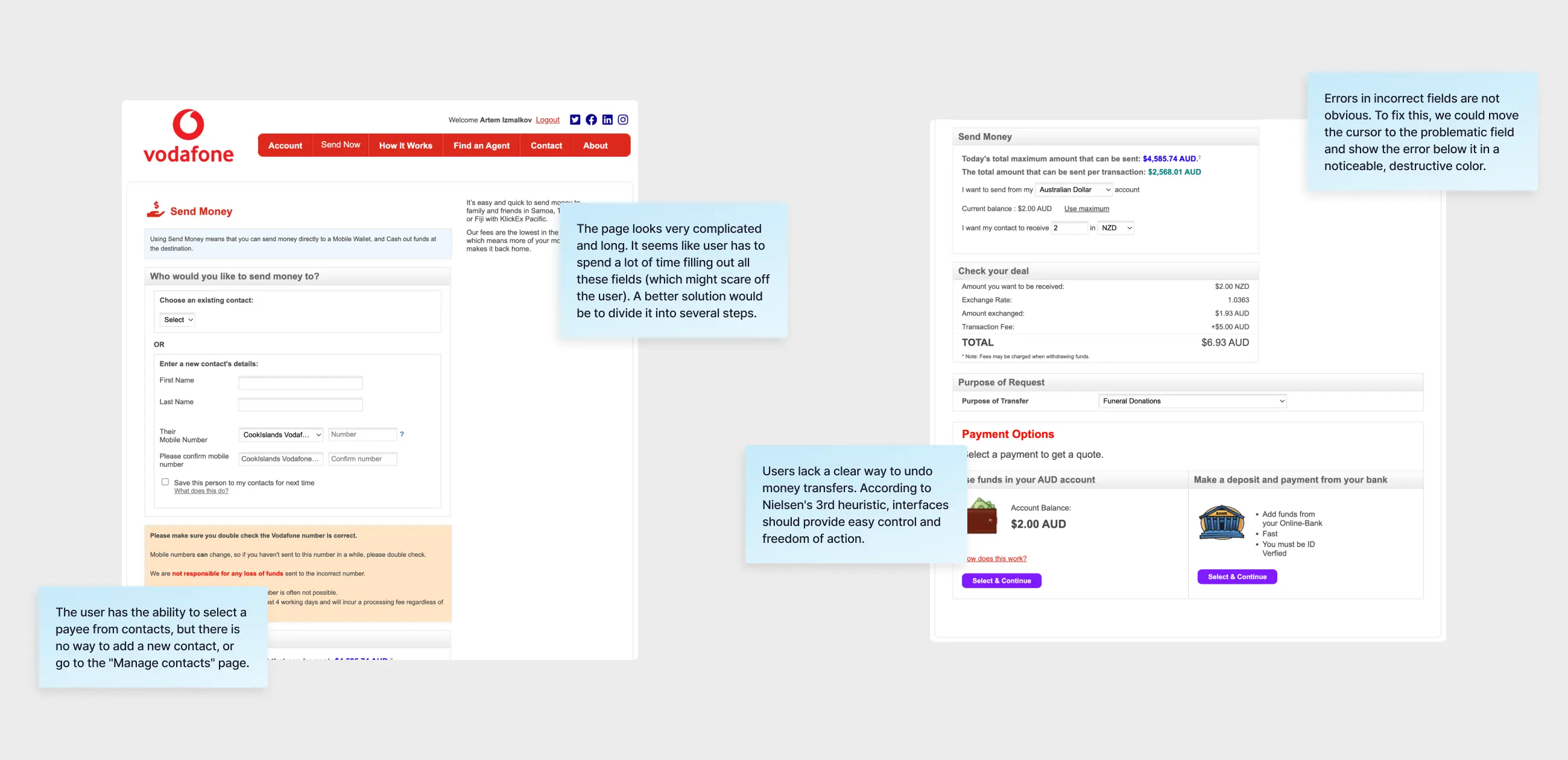

Our comprehensive UX audit of the existing KlickEx platform involved a thorough examination of the current design and functionality.

We meticulously analyzed user interaction patterns and identified critical usability barriers that were impacting the user experience. Through detailed evaluation of the platform’s interface, we documented design inconsistencies, assessed navigation patterns, and mapped out areas where users encountered difficulties during money transfer processes. Our team examined how the platform performed across different devices and regions, paying special attention to areas with limited connectivity.

We also conducted a thorough review of how compliance requirements were integrated into the user journey, ensuring that necessary security measures didn’t compromise usability.

This systematic analysis provided us with crucial insights that formed the foundation for our redesign strategy, focusing on simplifying complex processes while maintaining robust security and regulatory compliance.

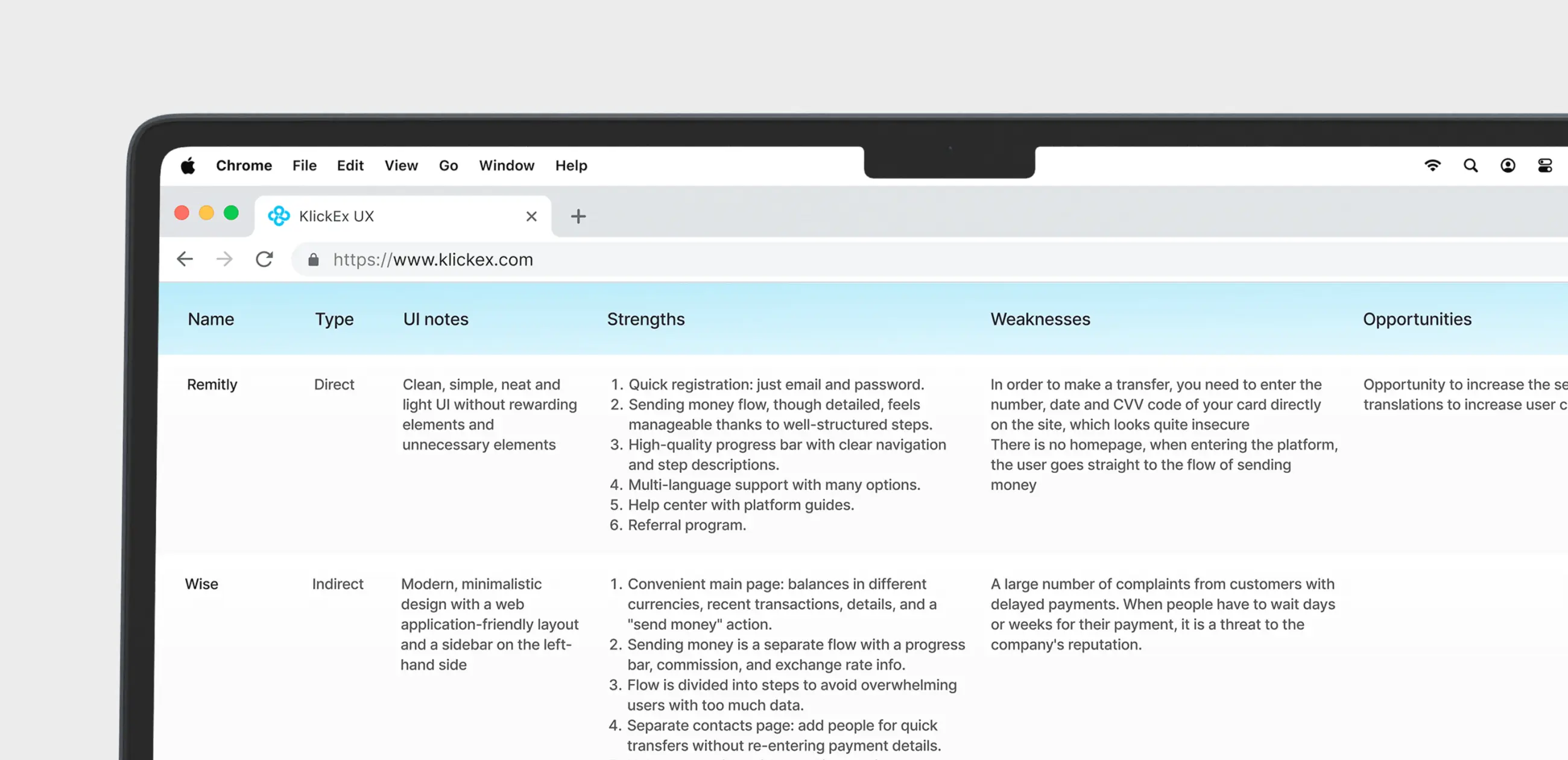

We conducted detailed competitive research of different platforms to identify industry best practices and potential areas for improvement. Through systematic analysis, we evaluated key strengths like simplified registration processes and multilingual support, while noting common weaknesses such as complex card verification flows and lack of clear homepage context. Our team mapped opportunities for enhanced security features and identified critical threats like payment processing delays that could impact user trust.

This competitive analysis provided valuable insights that helped shape our platform’s feature prioritization and user experience strategy, ensuring we could deliver a superior solution for Pacific communities.

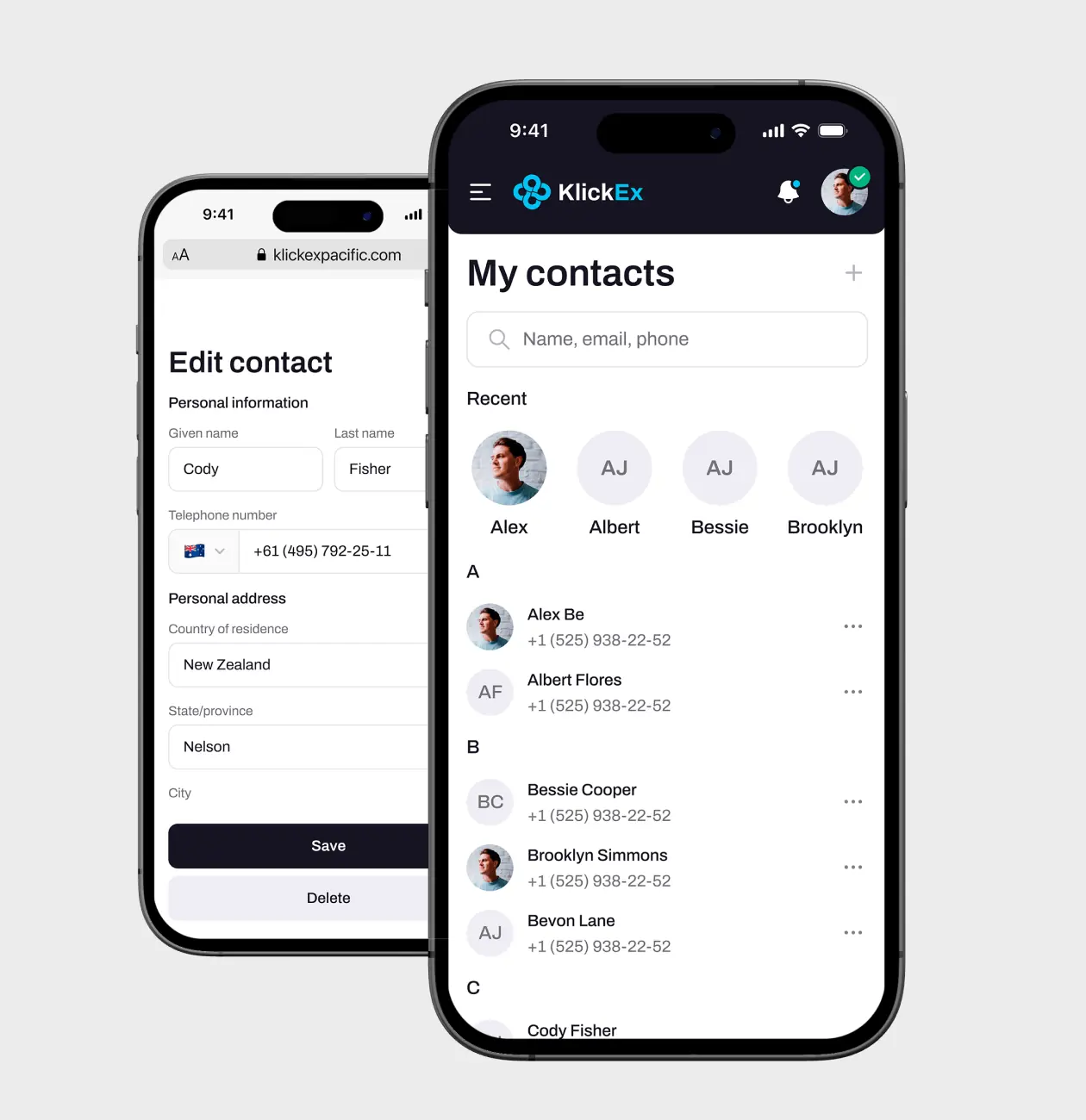

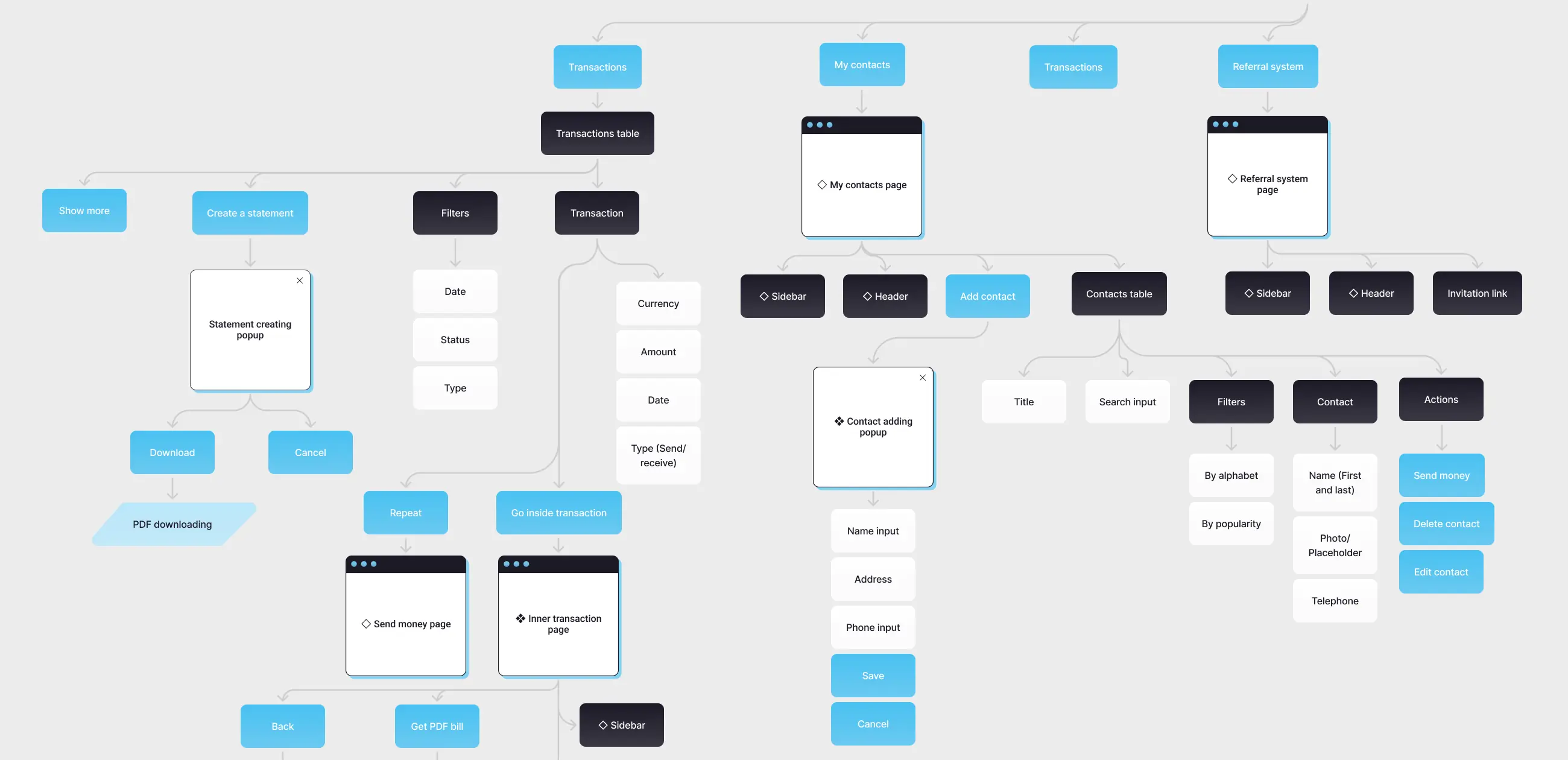

Our primary focus during the Information Architecture phase was creating an intuitive and simplified money transfer experience that would make financial transactions as effortless as possible. We strategically organized the platform’s structure to ensure users could complete transfers with minimal steps while maintaining necessary security measures.

Our team developed a clear hierarchical structure that guided users naturally through the transfer flow, from recipient selection to transaction confirmation. We simplified form fields to collect only essential information and reorganized navigation patterns to create shorter paths to frequent actions.

Our design approach for KlickEx focused on transforming complex financial operations into an intuitive digital platform that would resonate with Pacific Island communities. We prioritized creating a user experience that would make international money transfers feel as natural as sending a text message, while maintaining the robust security required for financial transactions.

Stages

- Wireframes

- Design direction

- UI design

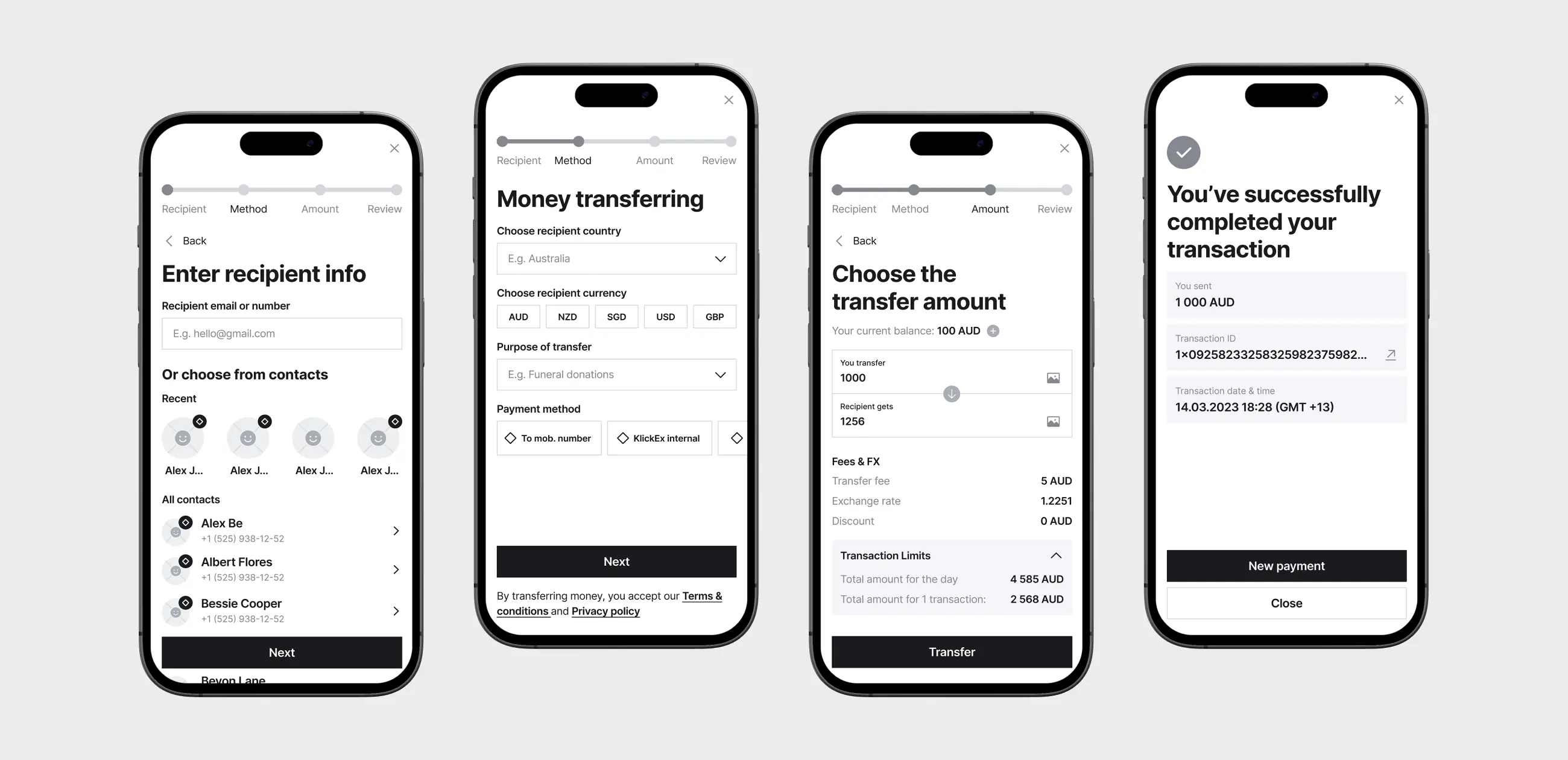

During the wireframing stage, we focused on two critical aspects of the platform.

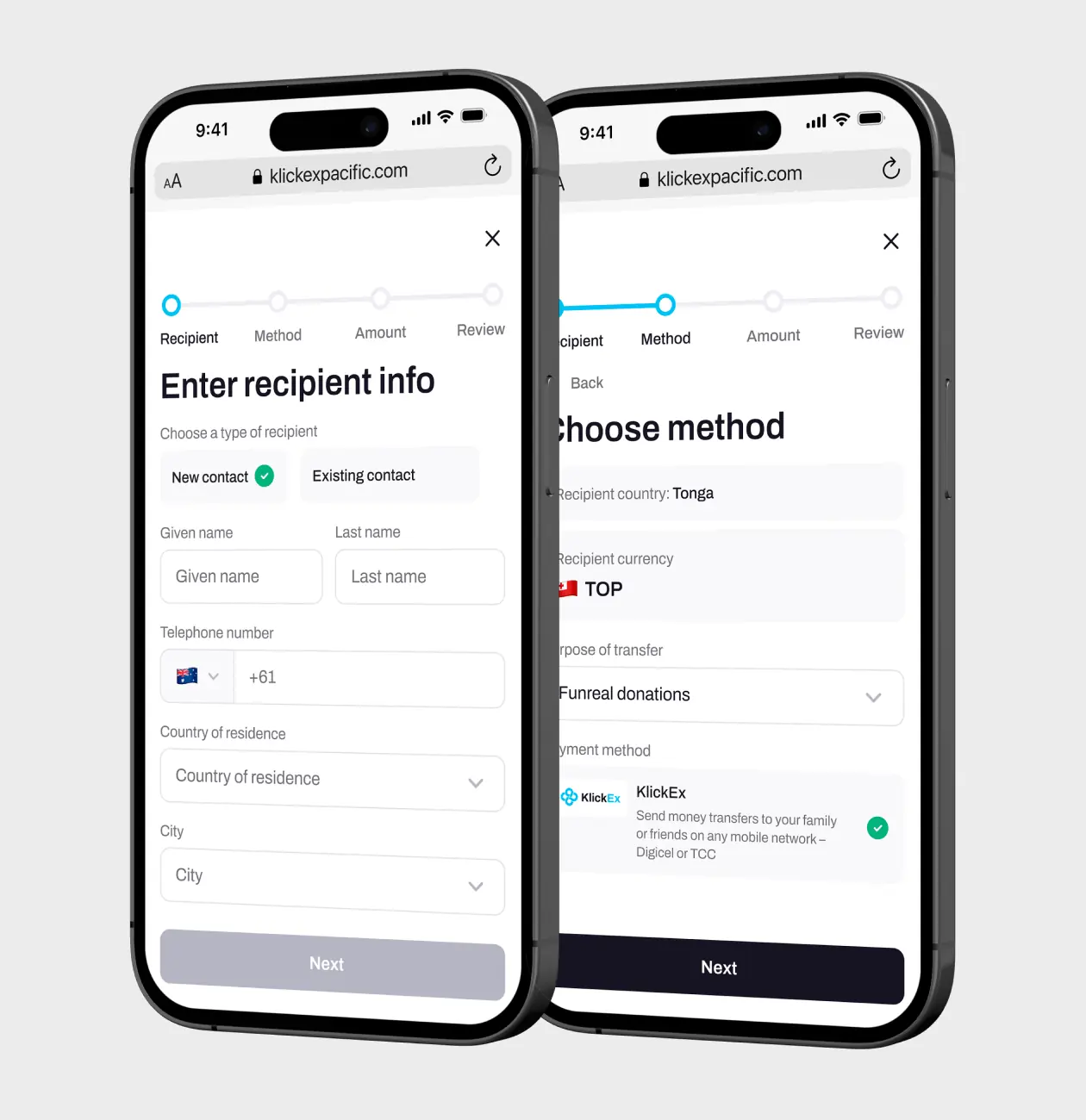

First, we mapped out essential money transfer flows, breaking down complex financial operations into simple, sequential steps. This included streamlining the recipient selection, amount input, and payment confirmation processes.

Second, we optimized every screen for mobile use, ensuring large touch targets, clear CTAs, and minimal data entry requirements. This mobile-first approach directly addressed the needs of our primary users – migrant workers who rely primarily on smartphones for financial transactions.

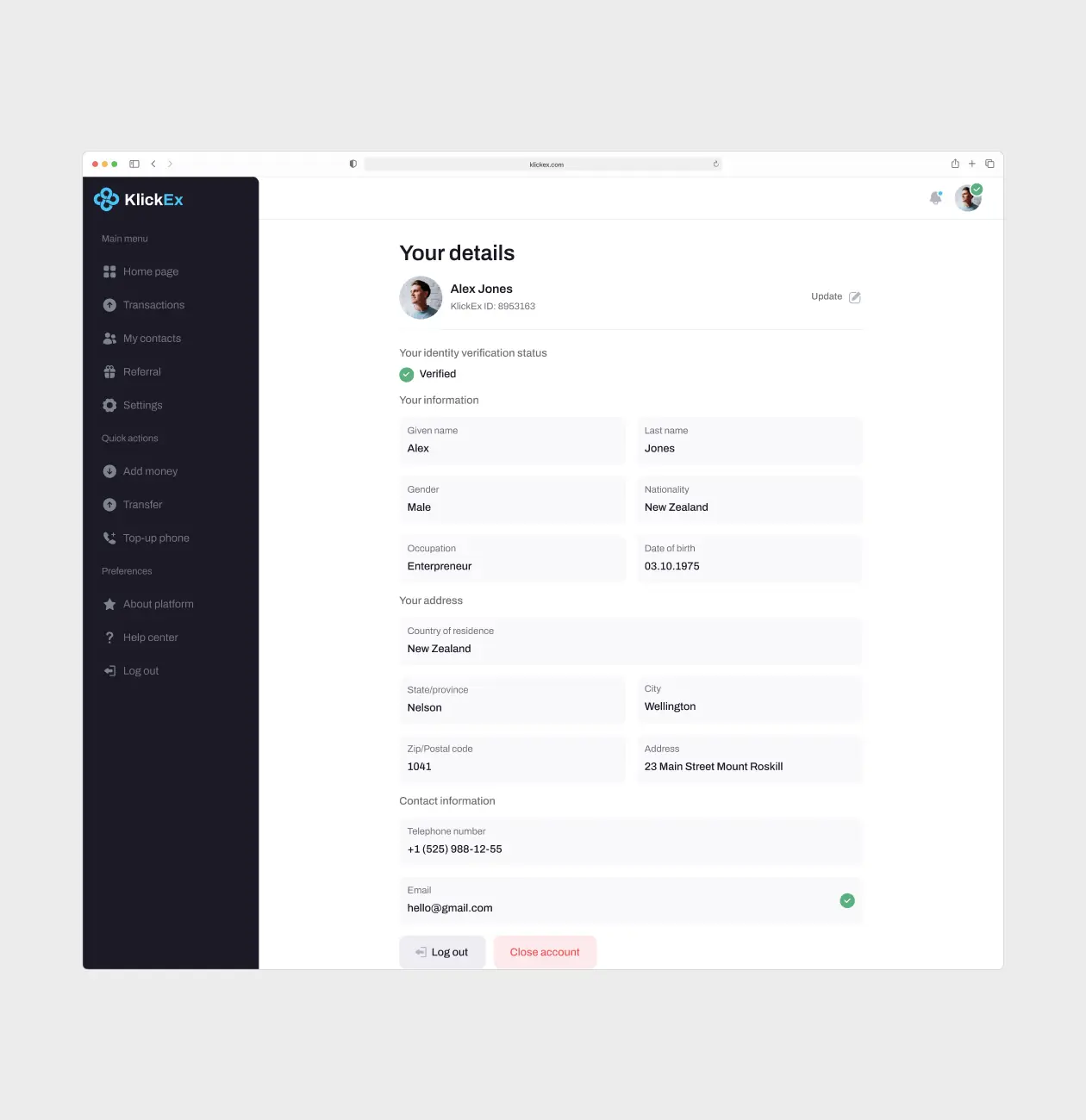

Our design process for KlickEx involved extensive collaboration with stakeholders to find the right visual balance.

We began by presenting two distinct design directions: “Simple & Clean” focusing on minimalistic, user-friendly layouts with clear hierarchy, and “Creative & Atmospheric” offering a bolder fintech aesthetic with dark mode options and dynamic elements.

Through client workshops, we identified that the Simple & Clean direction better served our target audience – migrant workers who prioritize function over form.

The final platform visual merged simplicity with professionalism, creating a design that feels both trustworthy and accessible to users with varying levels of technical proficiency.

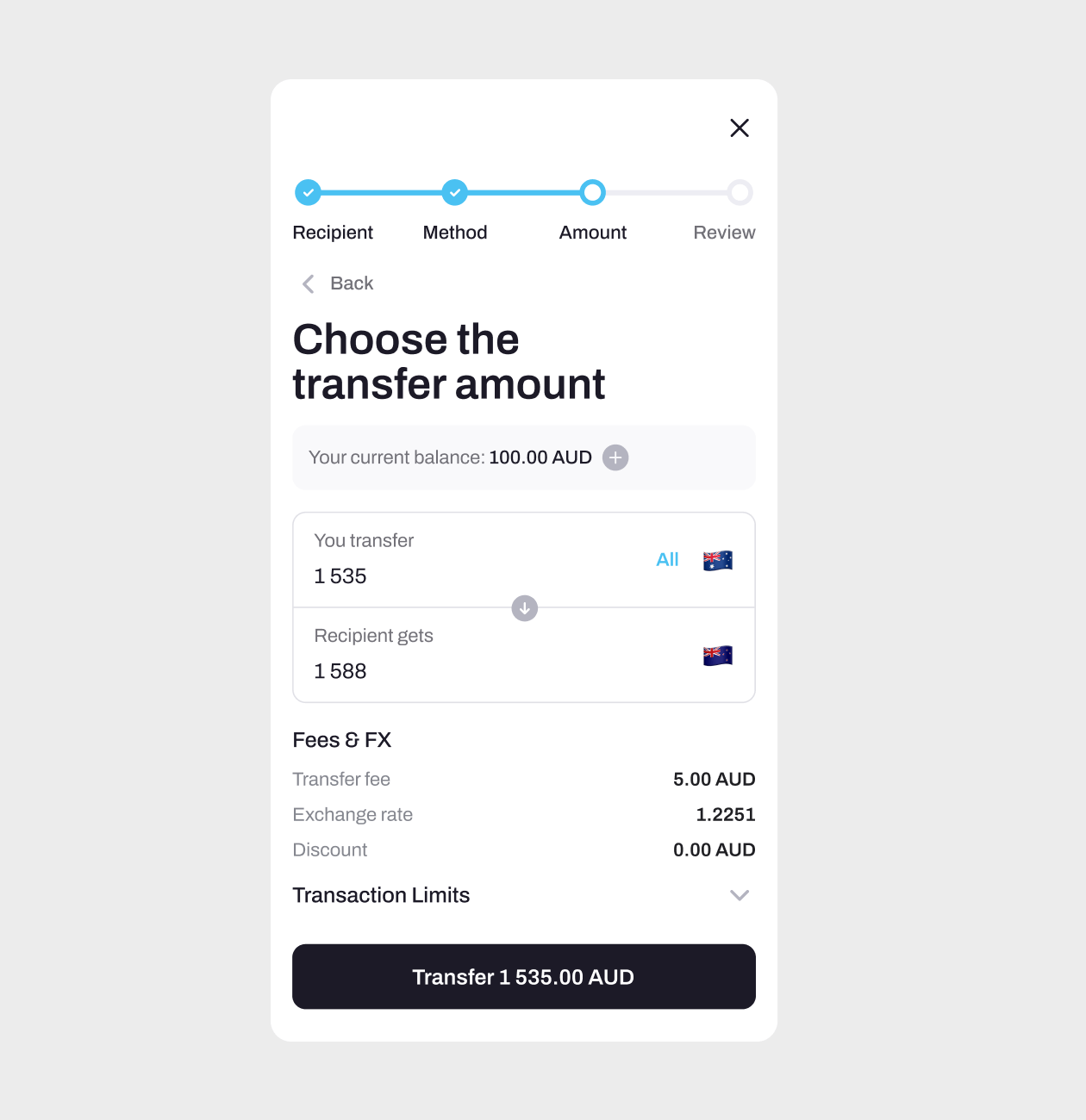

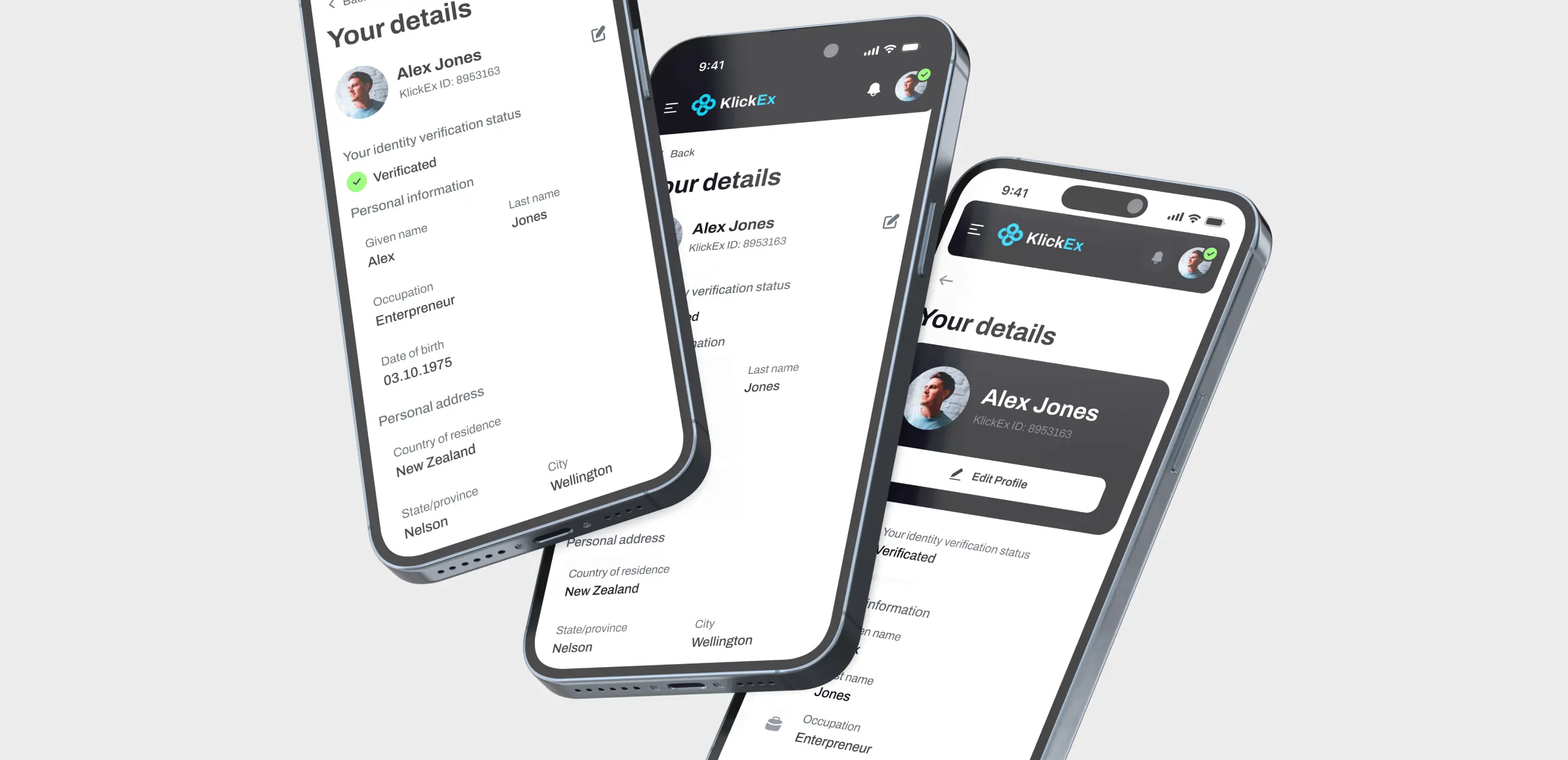

The final UI design focused on making complex financial operations accessible to users with limited digital banking experience. Working closely with the client, we developed specific visual solutions for key user flows.

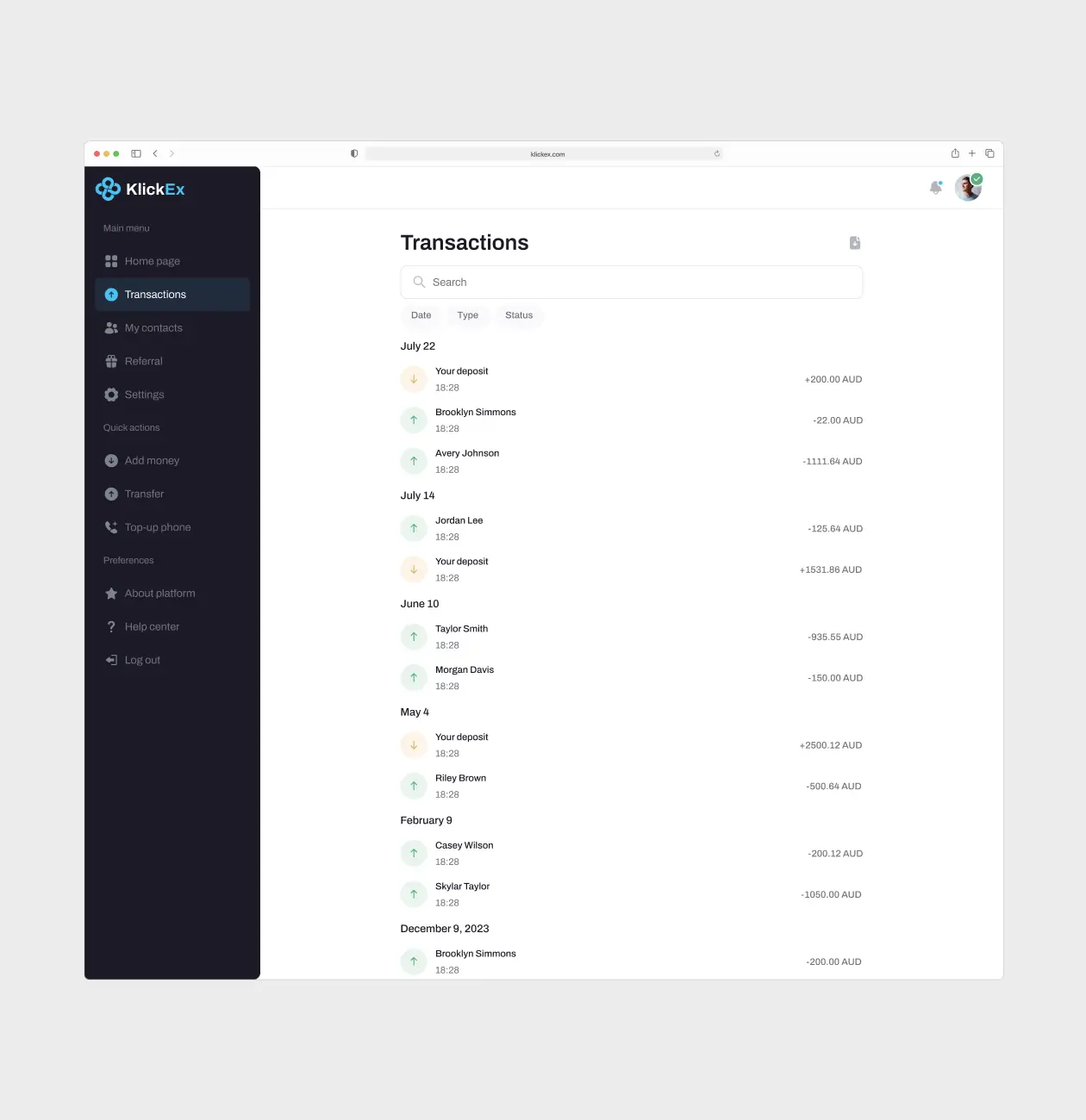

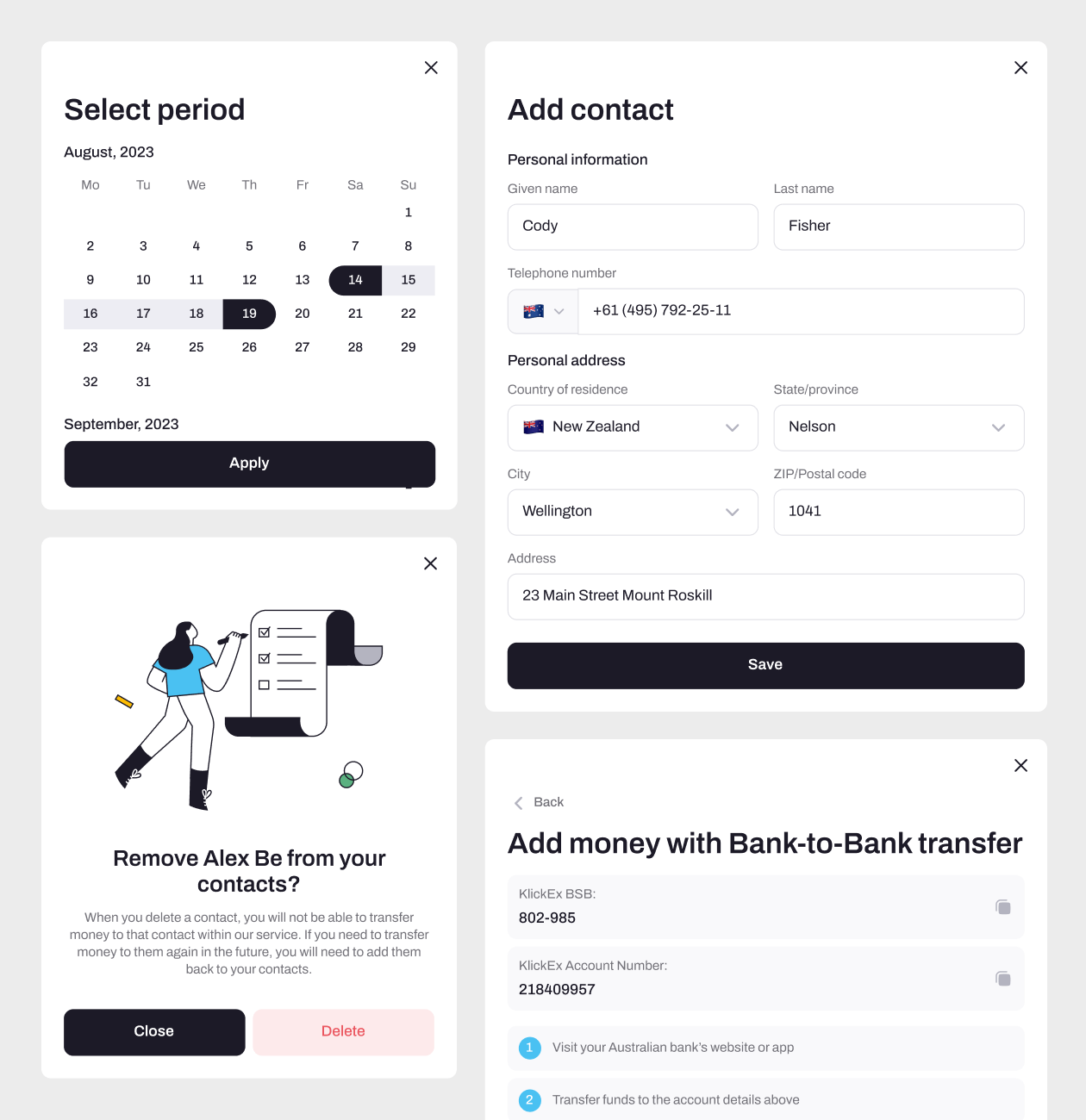

When designing the transaction history, the client preferred a detailed technical view showing all transaction parameters. Based on established UX best practices and competitive analysis of successful fintech platforms in similar markets we proposed a simplified timeline view focusing on key information (amount, recipient, status) with the ability to expand for details.

Initially, the client wanted to include multiple currency conversion options on the main transfer screen to demonstrate platform capabilities. However, our research showed this overwhelmed inexperienced users.

We developed a consistent design system that worked seamlessly across all devices, with special attention to mobile interactions. Also this design phase included extensive work on localization and language support, as our platform needed to serve diverse Pacific communities. Our design system was thoroughly tested across multiple languages to ensure consistent functionality and visual hierarchy

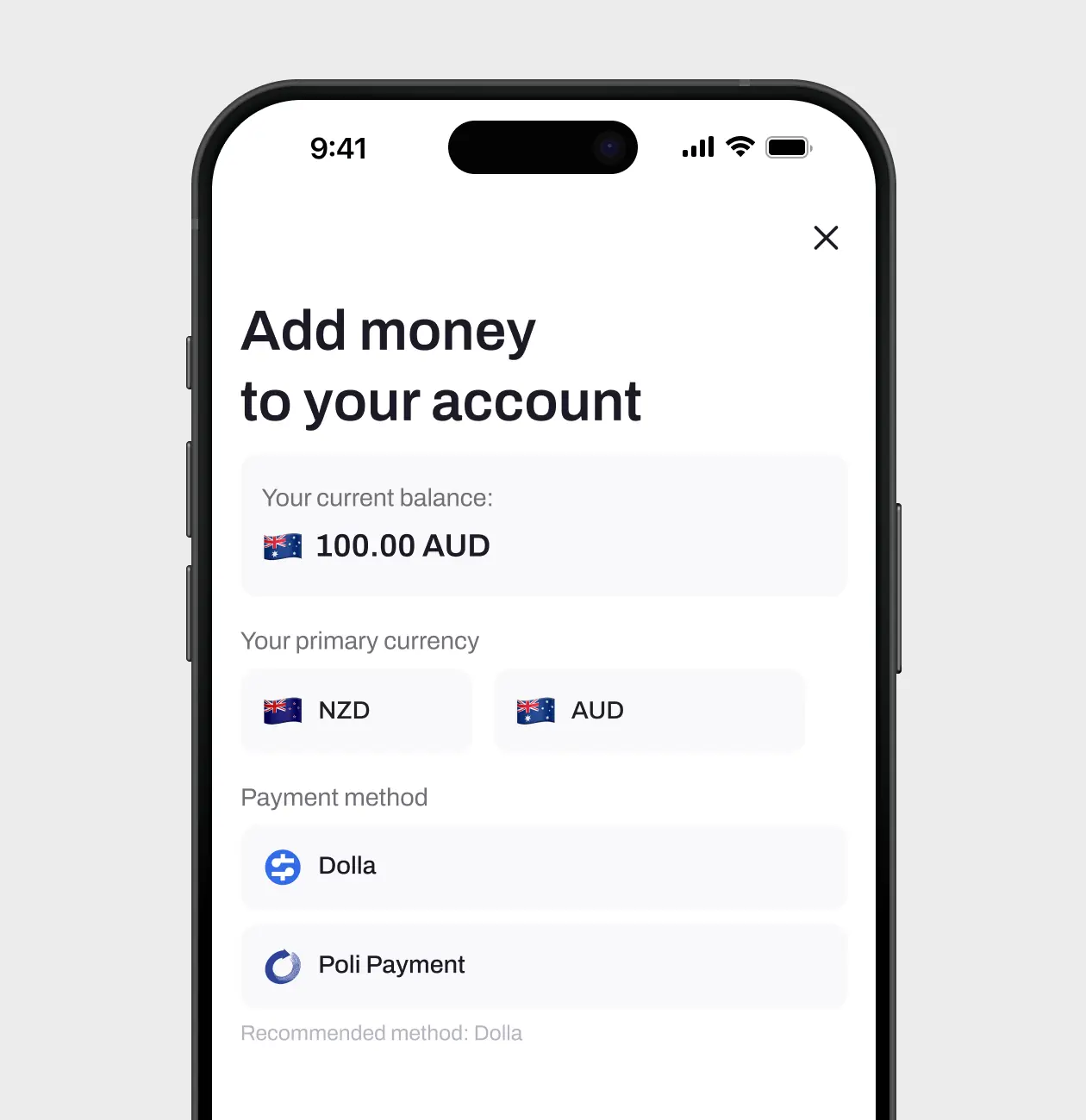

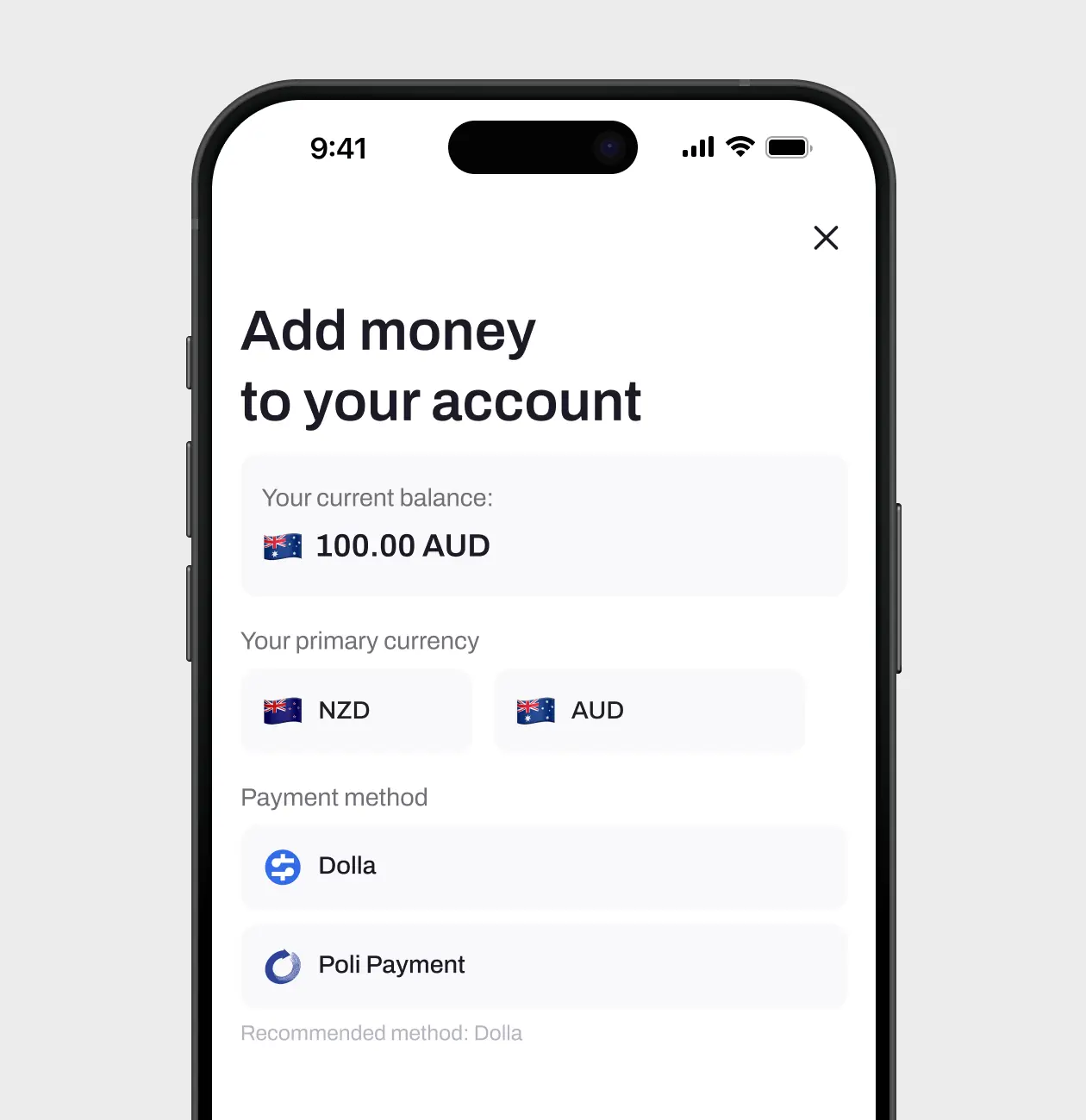

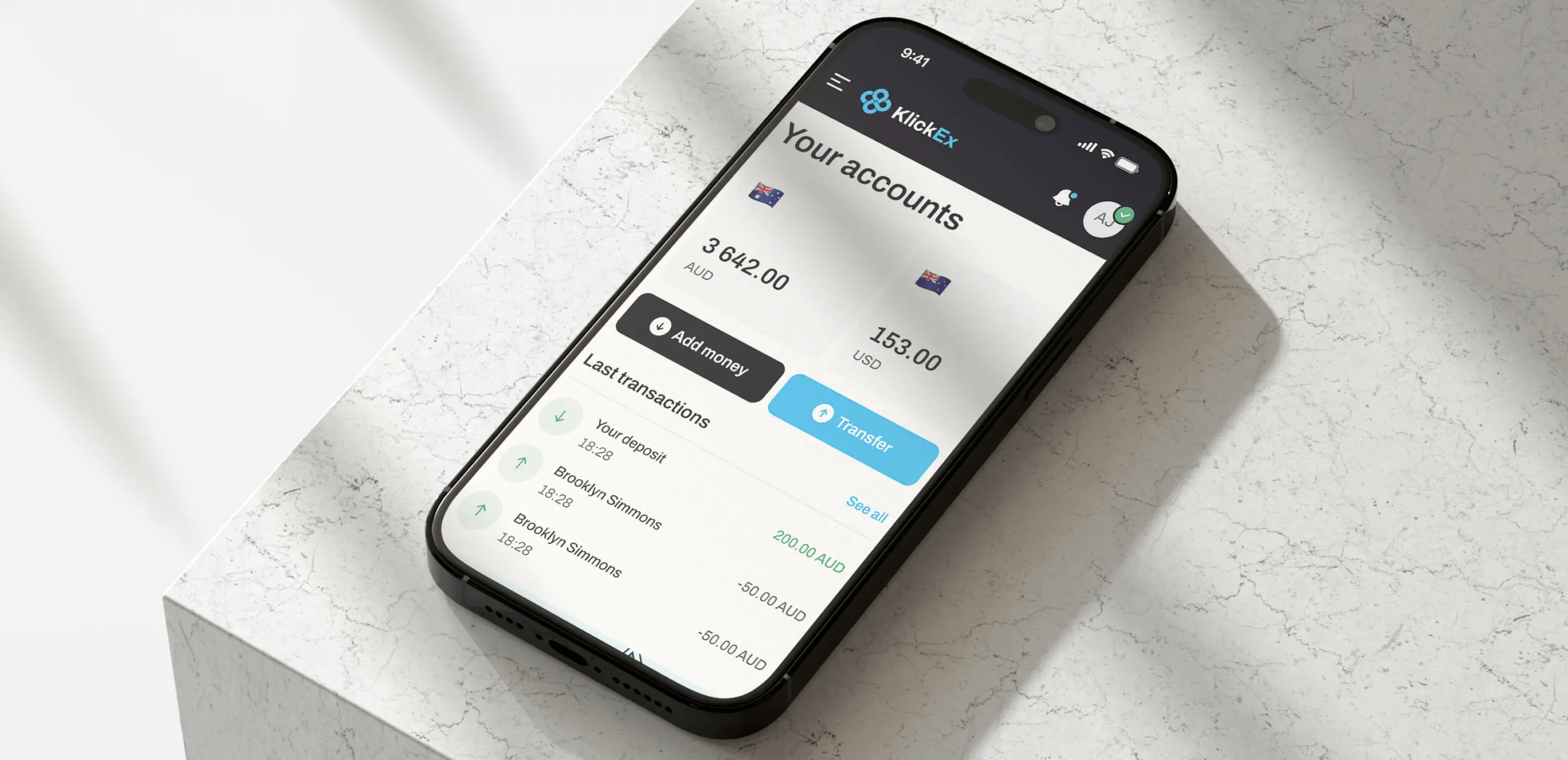

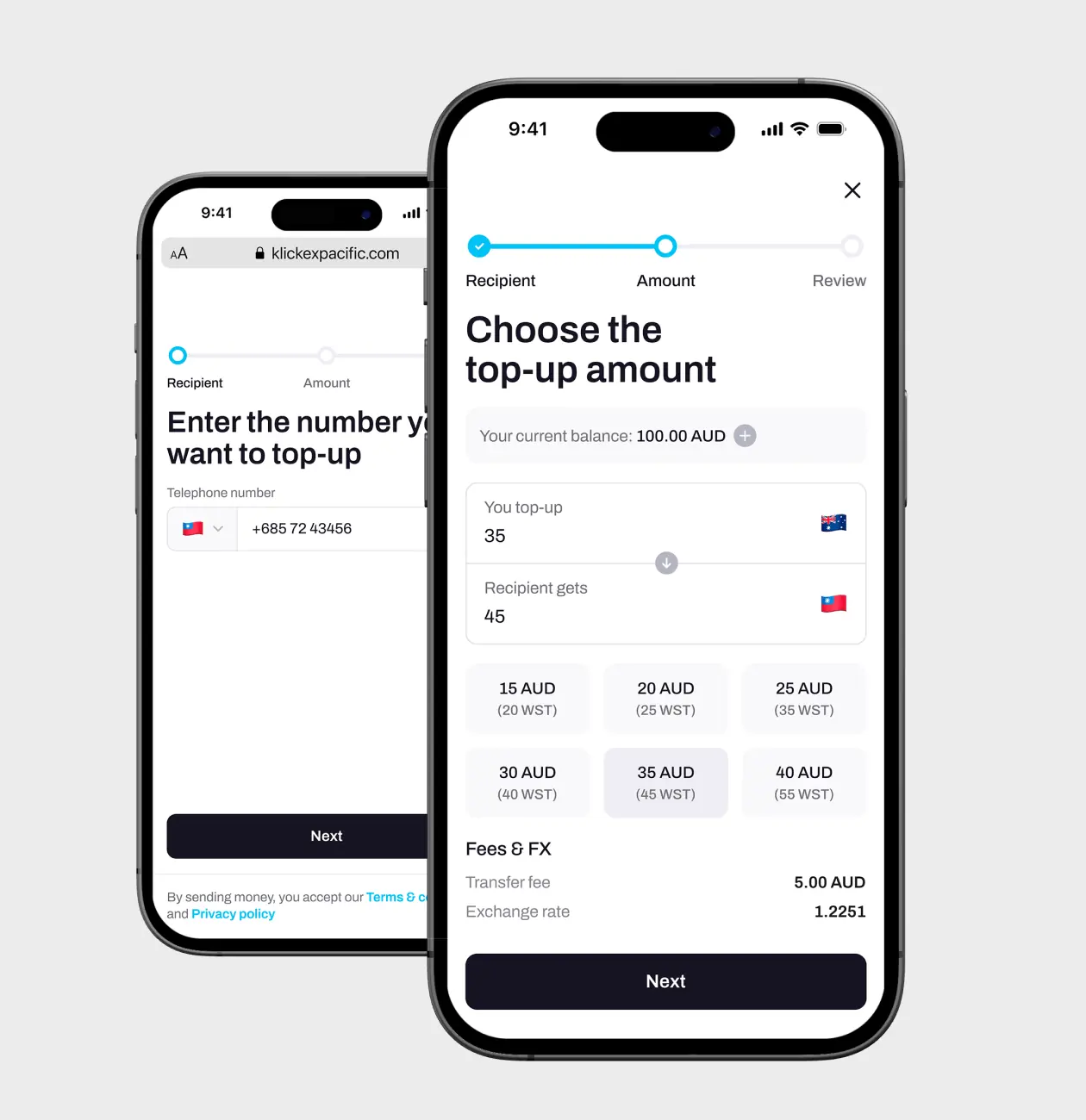

Money depositing feature supports multiple payment methods, making it convenient for users to fund their KlickEx wallets. The system displays real-time balance updates, current currency selection between NZD and AUD, and provides instant confirmation of successful deposits.

This flow has achieved a 35.3% improvement in conversion rates.

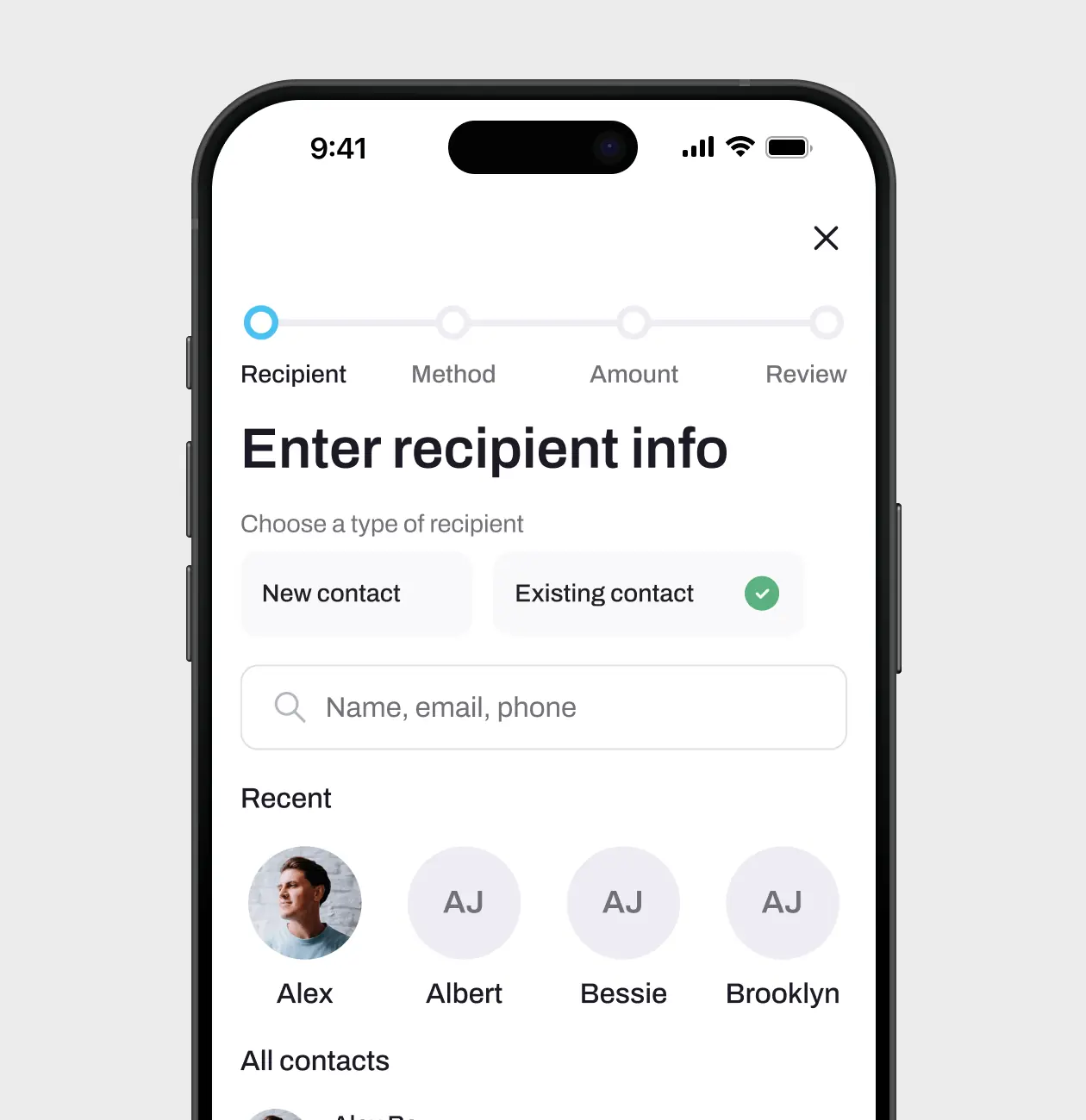

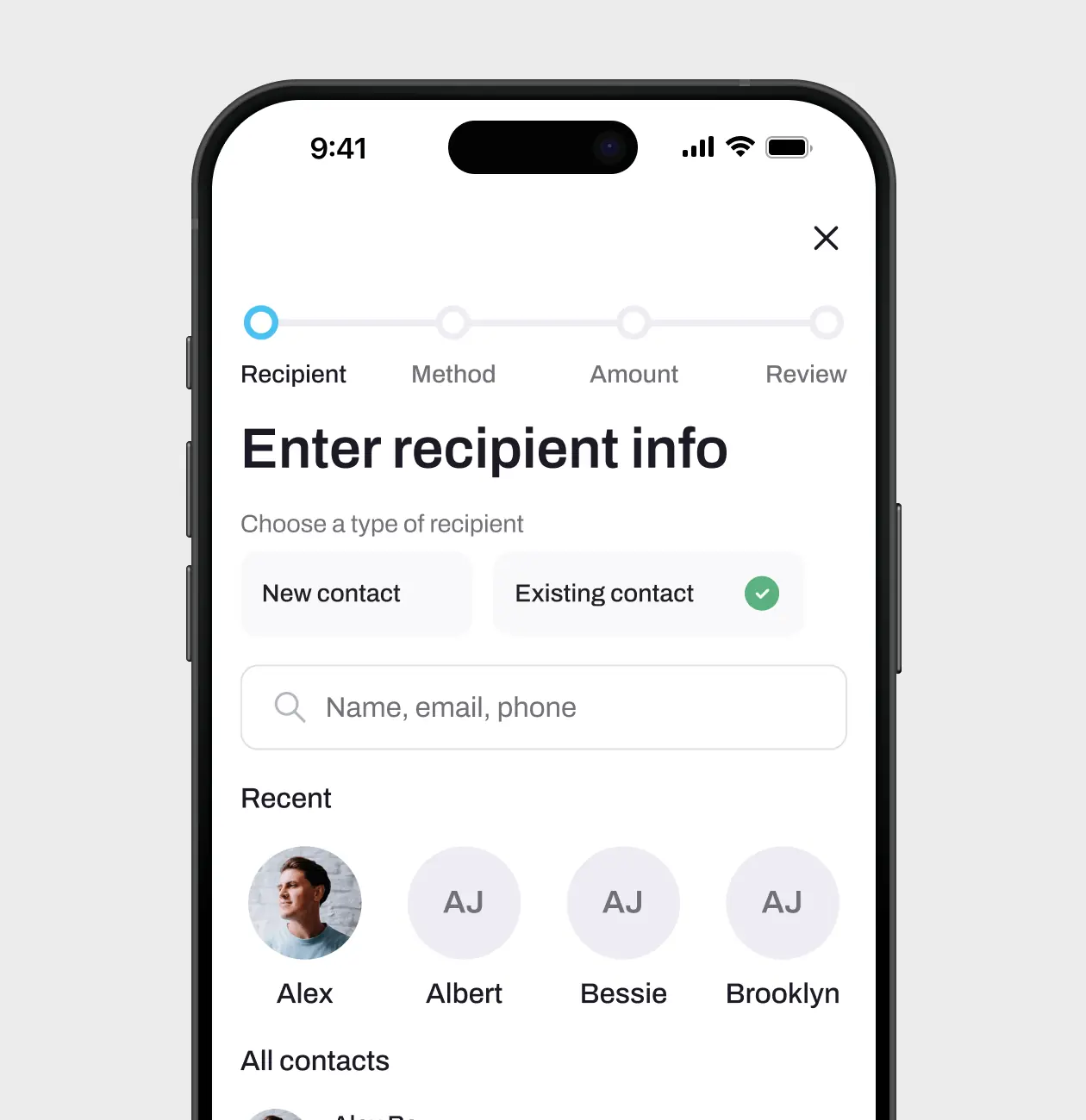

The core money transfer feature enables quick and secure cross-border transactions between supported Pacific nations. Users can send money to bank accounts or mobile wallets with transparent fee structures and competitive exchange rates.

The optimized Money Transferring flow, with its streamlined recipient selection and simplified steps, has achieved a 30.7% improvement in conversion rates.

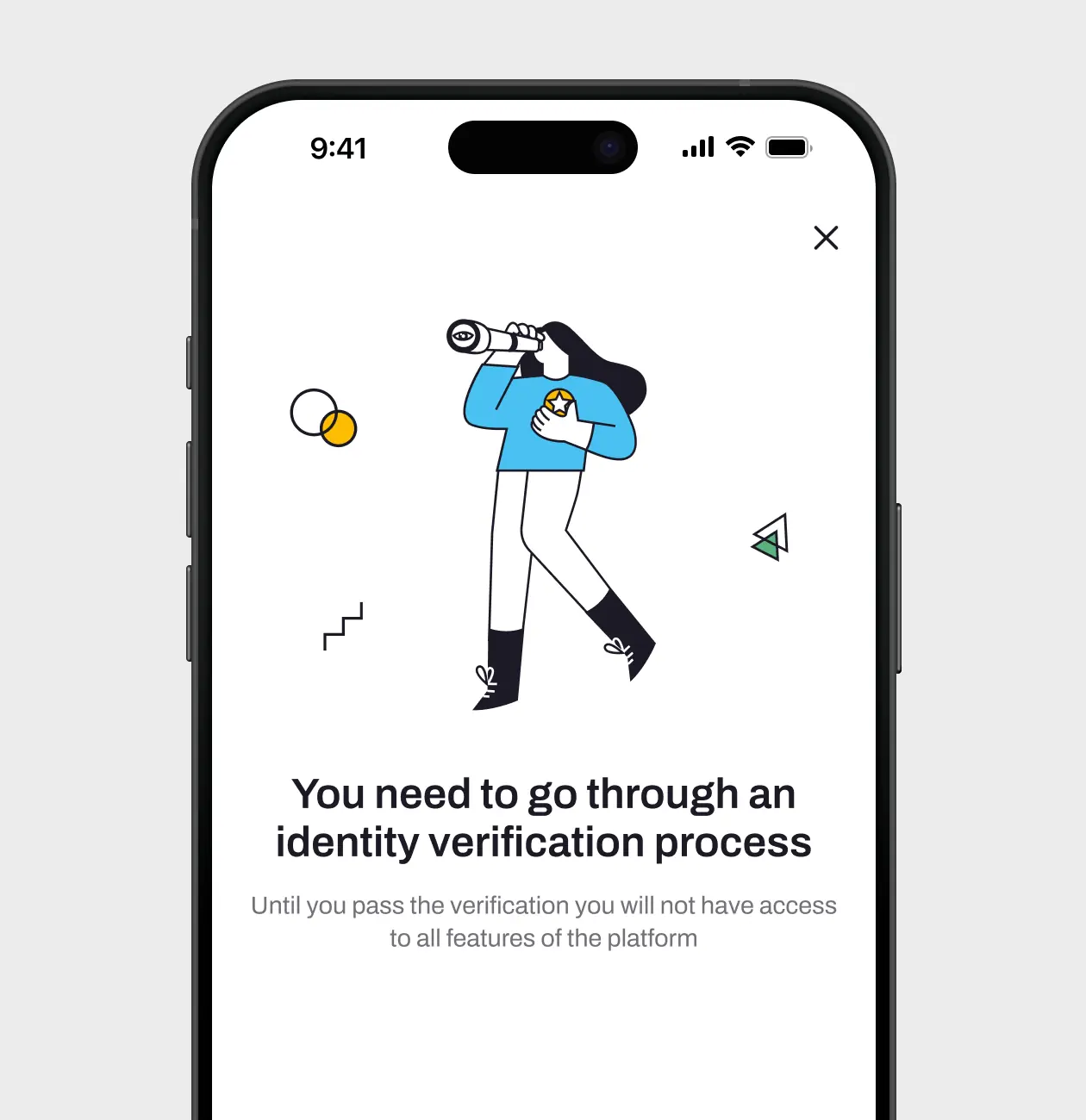

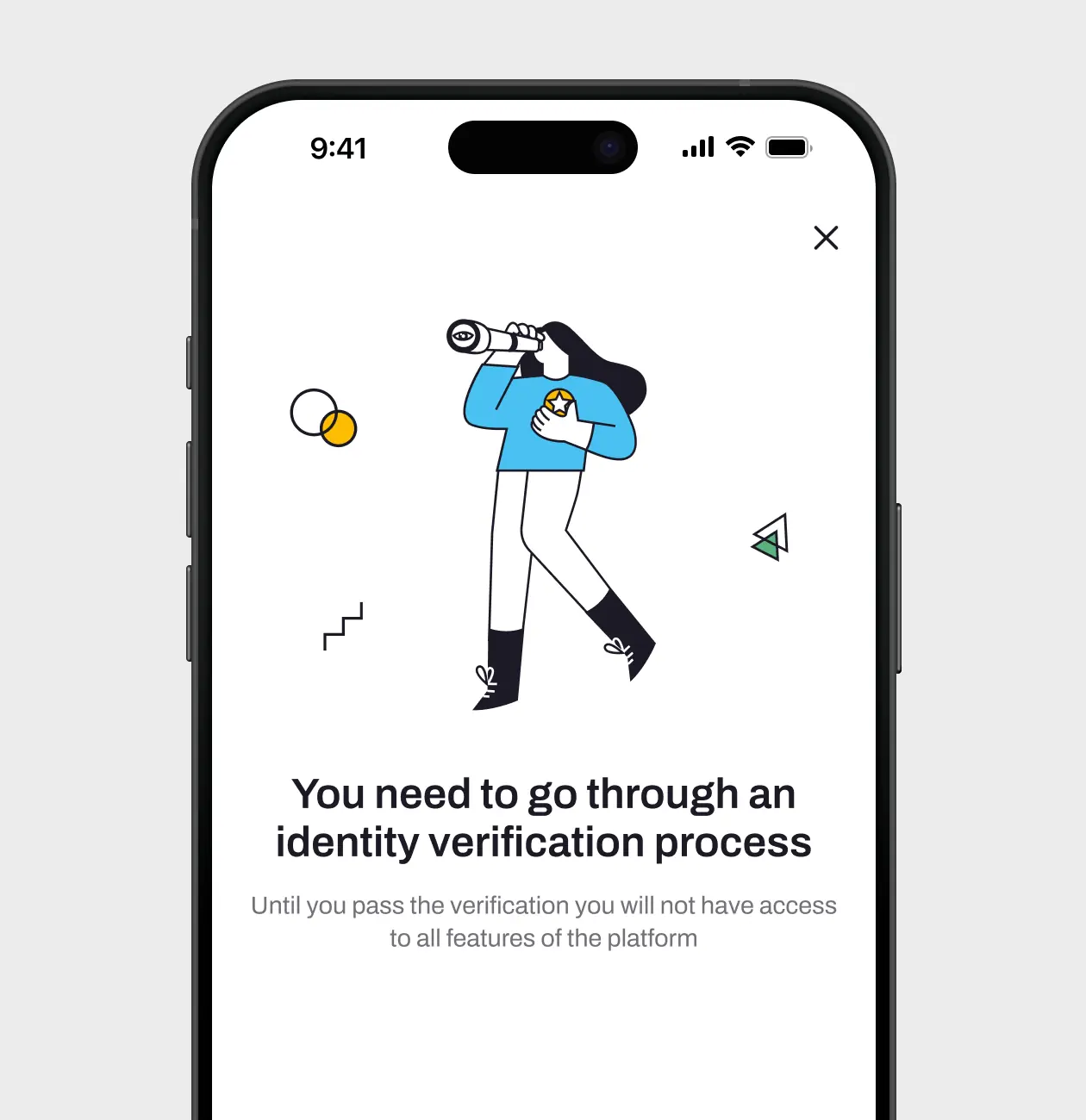

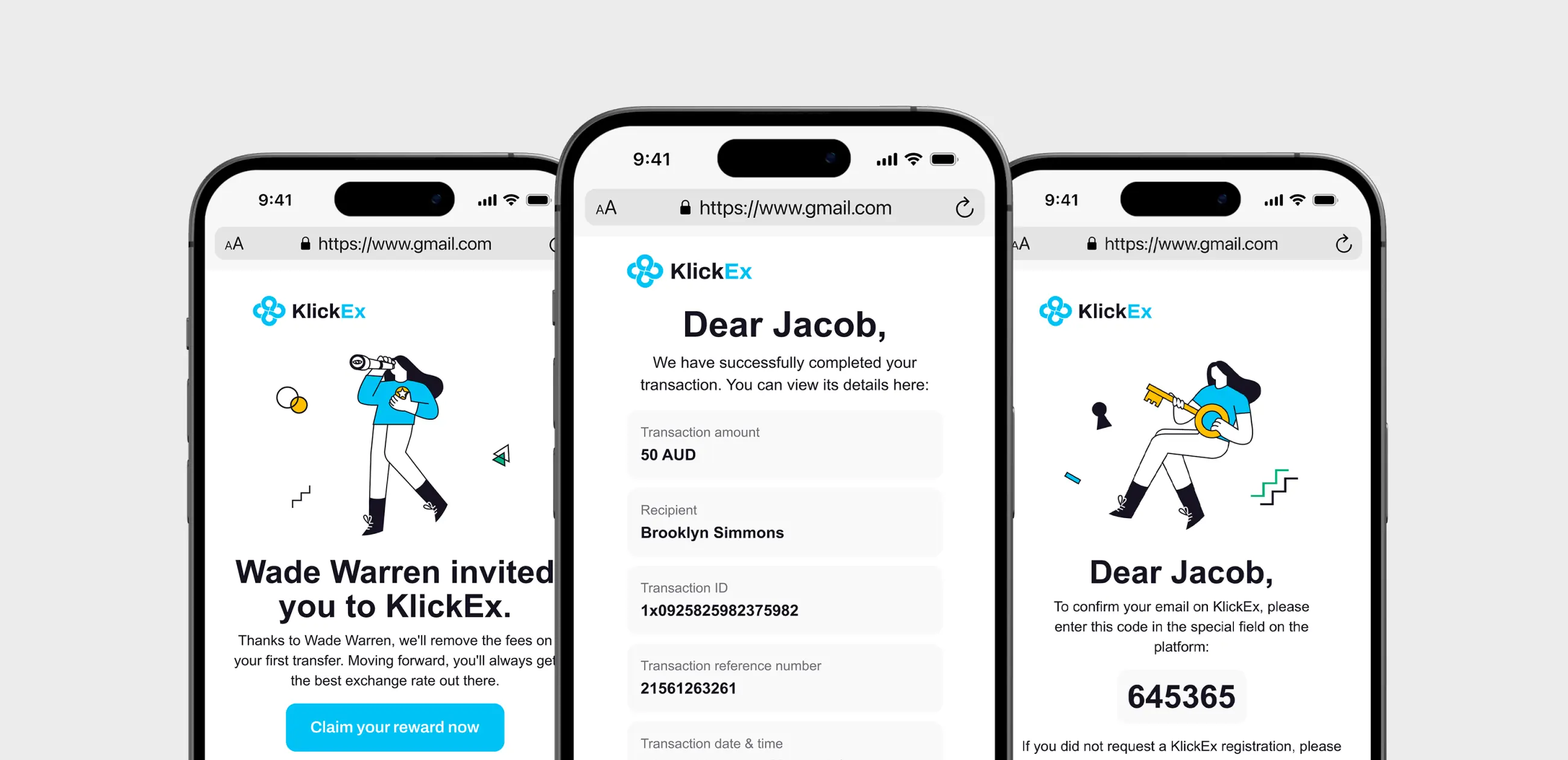

The current verification process exemplifies our approach to making complex financial requirements accessible - using friendly visuals and clear messaging to explain why verification is needed and what users gain from completing it. This design significantly improves the traditionally cumbersome KYC process while maintaining full regulatory compliance across Pacific jurisdictions.

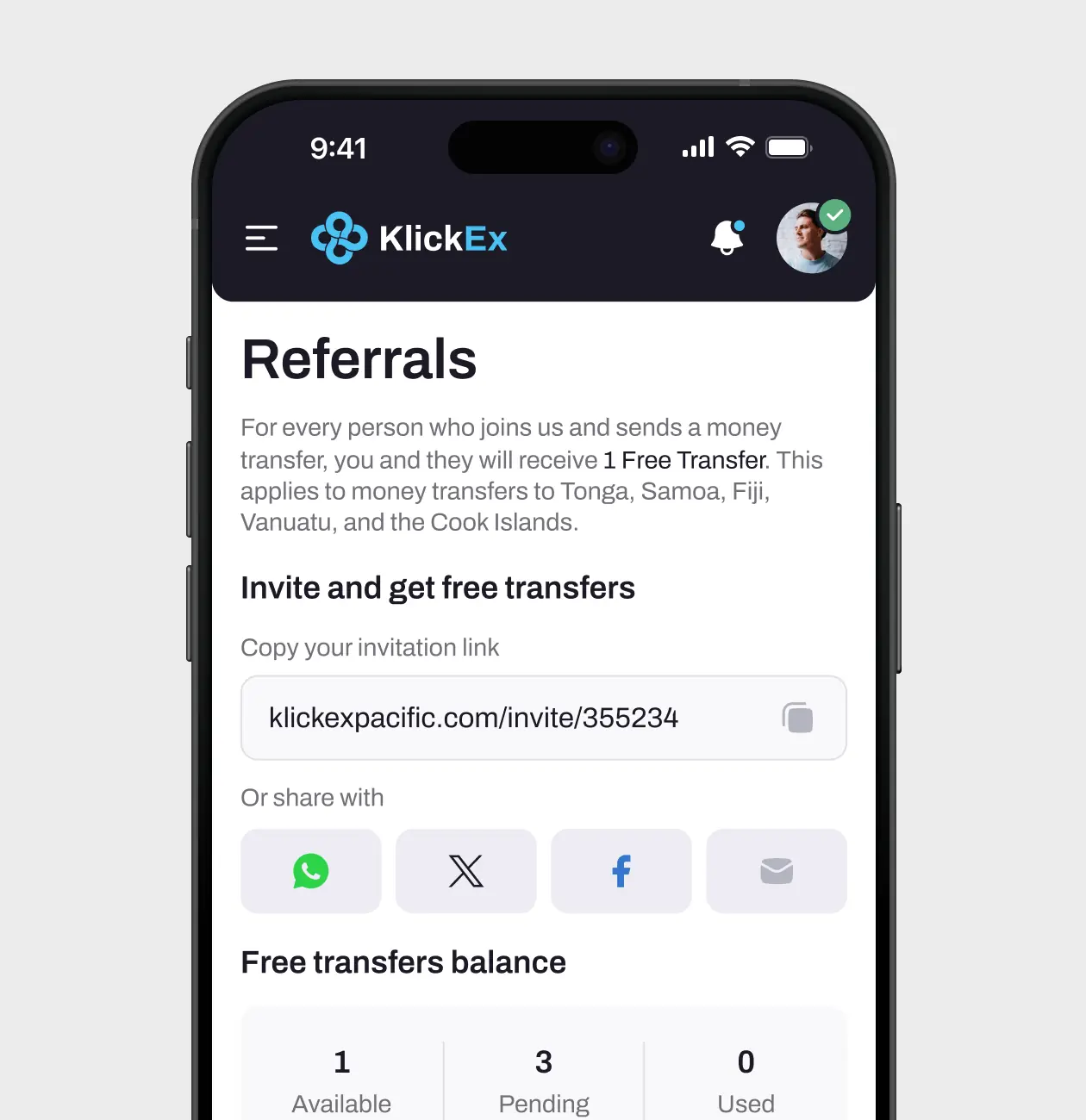

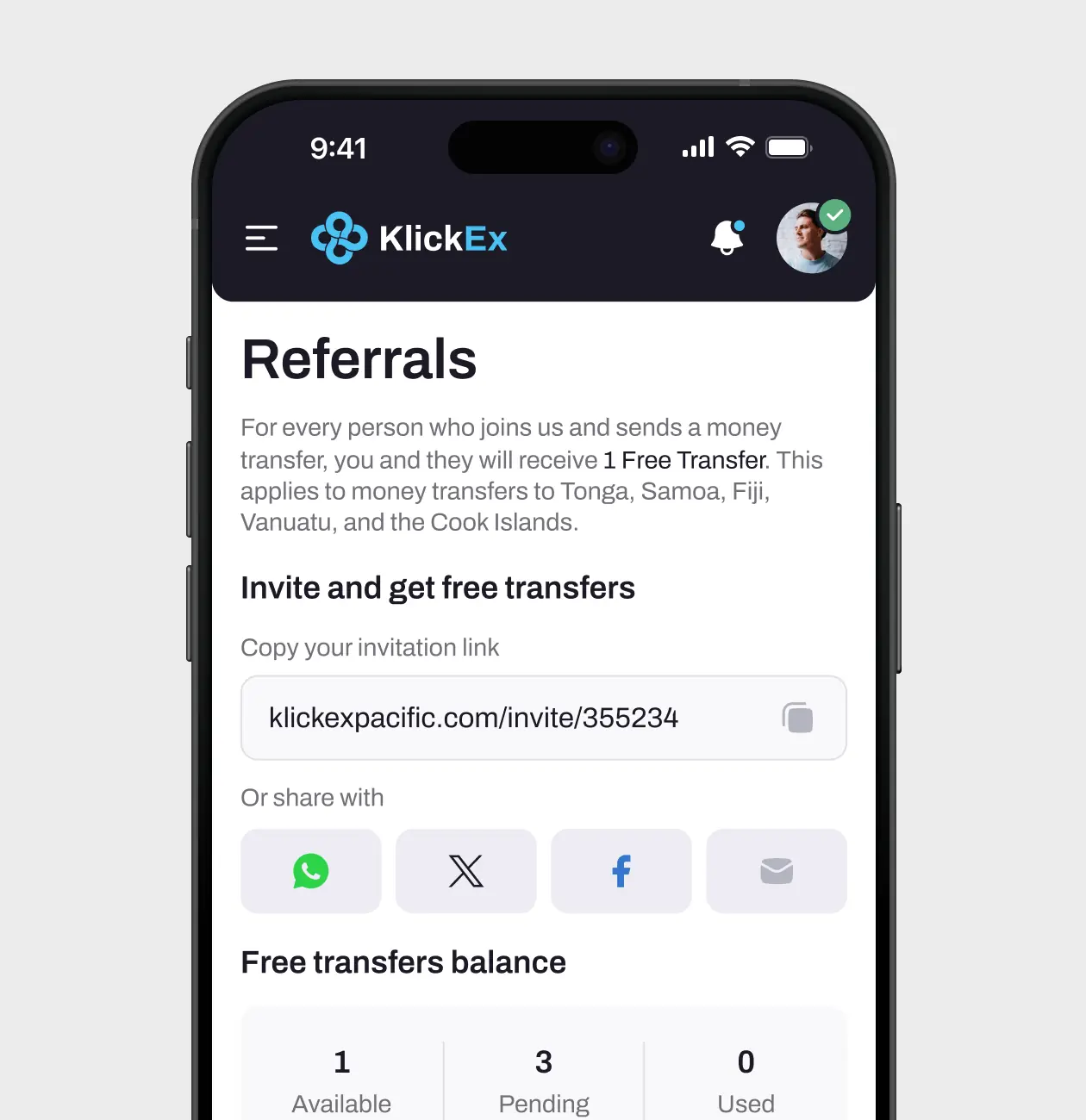

The integrated referral system encourages community growth by rewarding users who bring new members to the platform. This feature helps expand KlickEx's reach across Pacific communities while providing benefits to existing users.

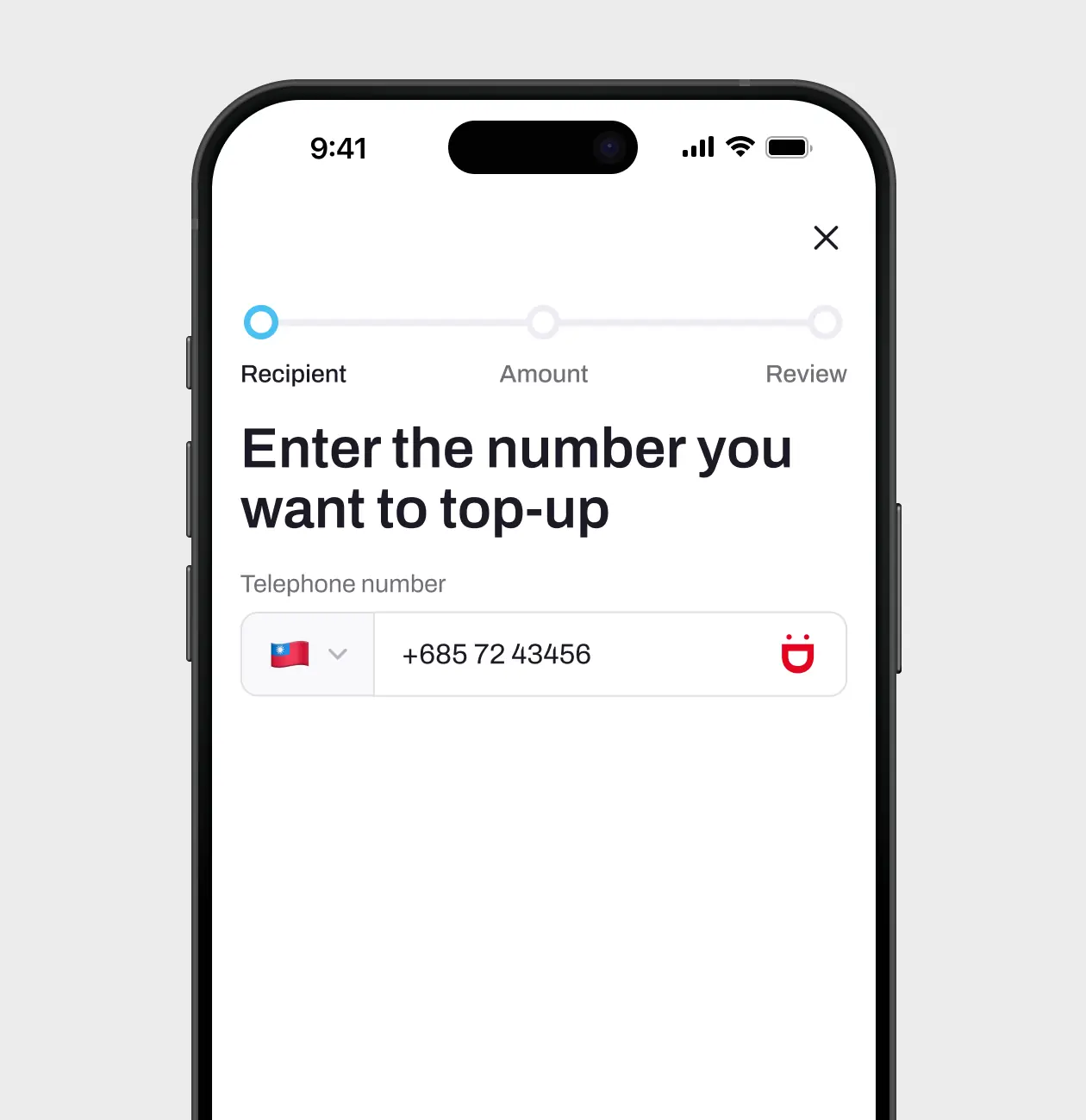

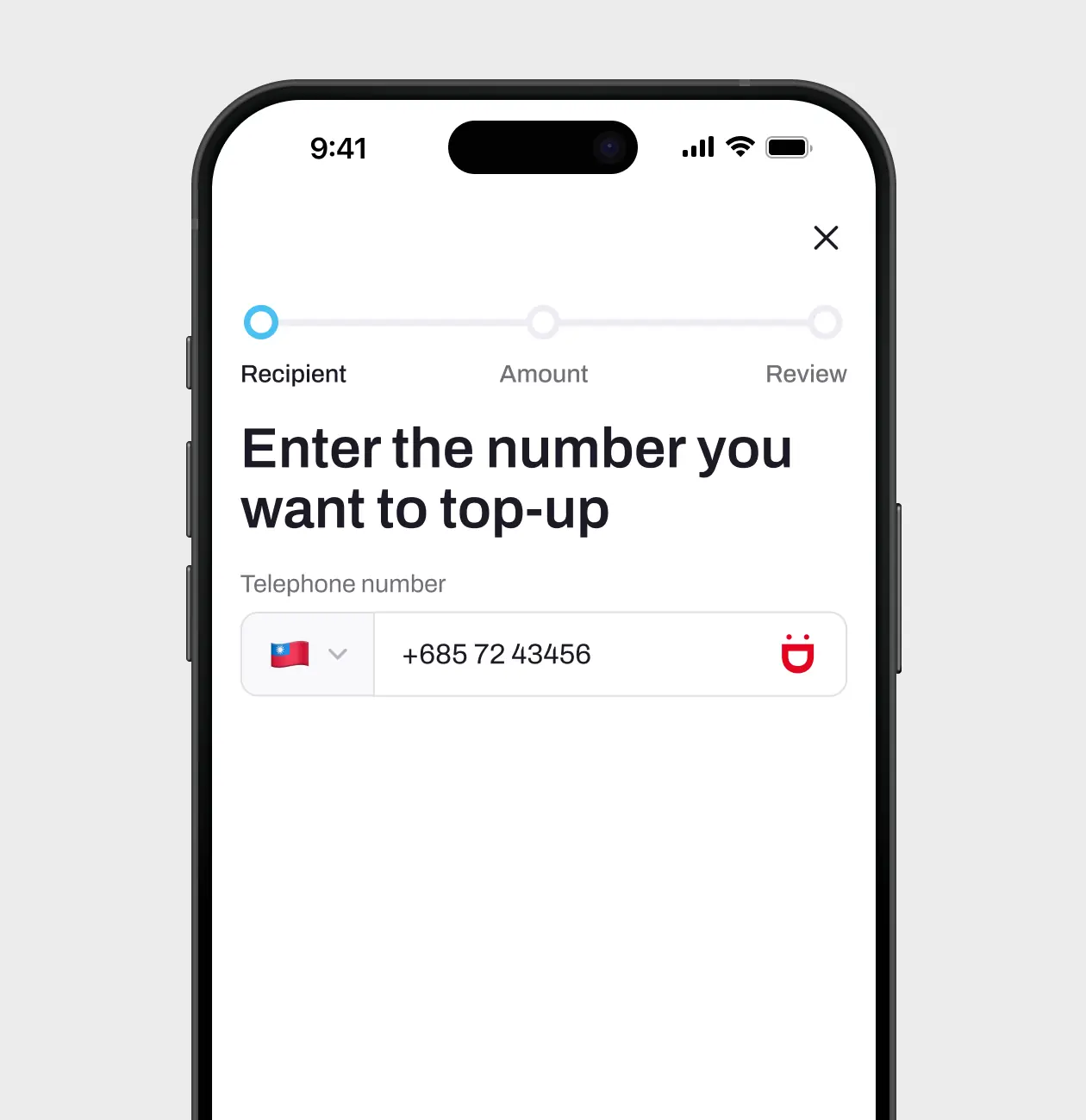

The mobile top-up service allows users to easily recharge prepaid phones across supported countries. This feature integrates seamlessly with local mobile operators, providing instant top-up confirmation and balance updates.

Our approach to developing the KlickEx platform was grounded in strategic technology choices designed to deliver both high performance and robust reliability.

Next.js was selected for its advanced capabilities, including server-side rendering (SSR) and static site generation (SSG), which ensure fast load times and smooth user experiences, even in low-bandwidth conditions. This choice allowed us to create a responsive and efficient platform tailored to diverse network environments.

To maintain code stability and scalability, we utilized TypeScript, which provided strong type checking and minimized potential bugs during development. For managing the complex state of financial transactions, we implemented React Redux, ensuring seamless and efficient data handling across the platform.

Authentication and user security were critical priorities. By integrating Auth0, we provided a secure, reliable login system that enhanced user trust while maintaining a frictionless authentication process.

This thoughtful combination of technologies enabled us to deliver a high-performing, secure platform tailored to the demanding needs of the financial industry.

1. Payment systems integration

Comprehensive integration with multiple payment providers enables flexible payment options including Cards, Bank Transfers, Online Banking, and PayId, ensuring accessible financial services across all supported regions.

2. Mobile top-up services

Direct integration with Vodafone and Digicel enables seamless mobile balance recharging, providing users with instant top-up capabilities across supported Pacific networks.

3. Authentication service

Integration with Auth0 delivers enterprise-grade security while maintaining a streamlined user experience, ensuring safe and efficient access to all platform features. This solution significantly reduced development costs by eliminating the need to build and maintain a custom authorization system.

Switzerland

Switzerland

Slovakia

Slovakia