If you’re a fintech founder or product owner, updating your UI could lead to big gains in user acquisition, retention, and profitability.

Financial technology is one of the fastest growing industries in the digital space, offering users new ways to manage finances, invest, and pay, with financial UX design playing a crucial role in creating user-friendly and memorable experiences. But beneath the surface of many successful fintech companies lies an often overlooked problem – an outdated user interface (UI). Outdated fintech UIs aren’t just a cosmetic issue; they can have a direct and significant impact on your bottom line by hindering financial processes, making it harder to comply with regulatory requirements and manage compliance efficiently.

If you’re a fintech founder or product owner, updating your UI could lead to big gains in user acquisition, retention, and profitability. This post will break down why outdated UIs cost more than you think and what you can do about it.

Introduction to Fintech

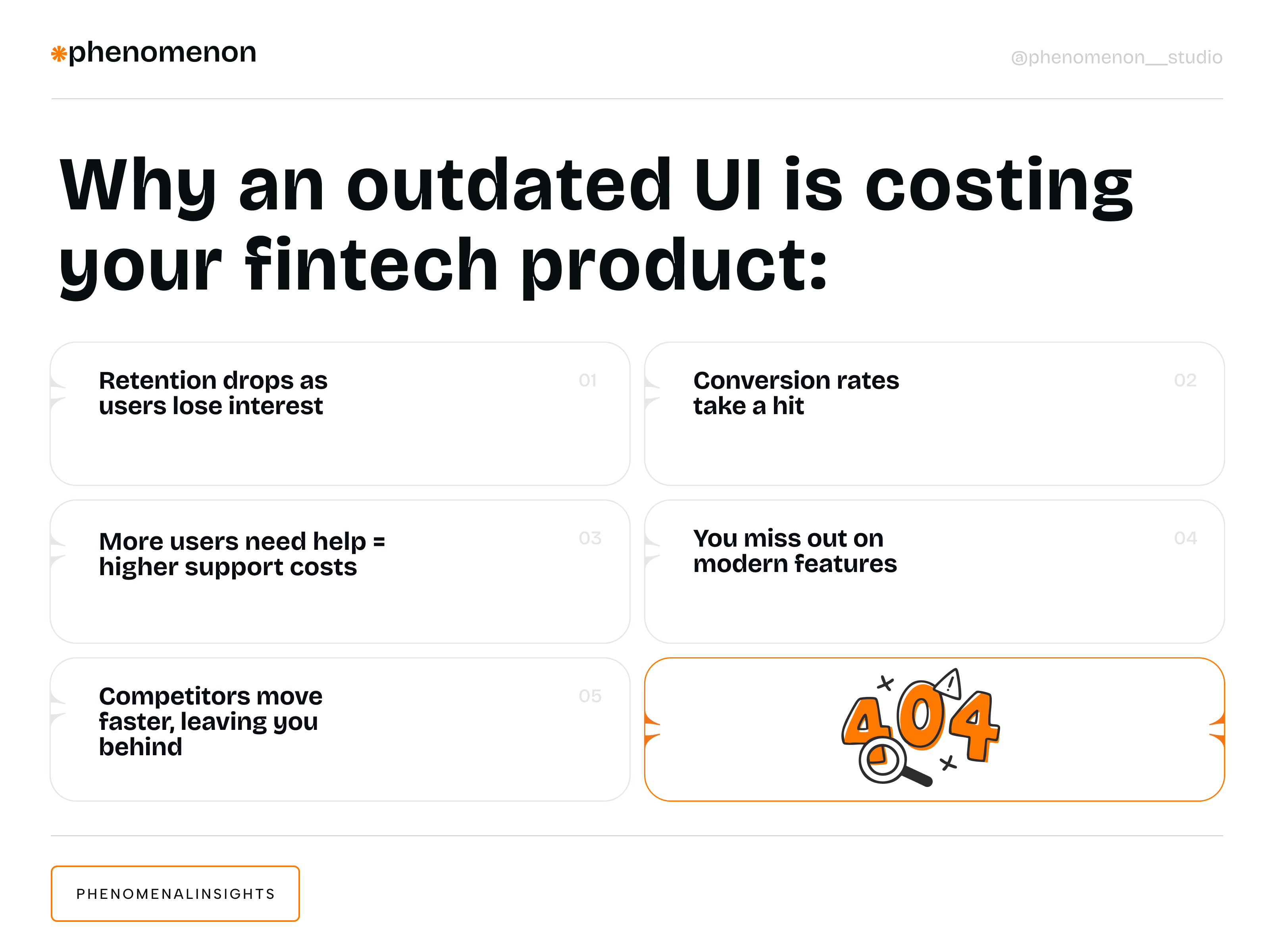

What’s the Cost of an Outdated Fintech UI?

It’s easy to focus on features or backend development and neglect the front-end interface. But an outdated UI can silently—and severely—hurt your business in the following ways:

1. Lower User Retention

Users expect slick digital experiences. According to a Forrester report, 76% of people say the most important thing in an app is ease of use, with intuitive design close behind.

If your fintech app looks or feels outdated, users are more likely to abandon it for competitors with better designed banking apps. High churn rates means all the resources you spend on acquiring users is wasted.

2. Lower Conversion Rates

First impressions matter. A Stanford study shows 75% of users judge a company’s credibility based on its website design. If your UI doesn’t inspire confidence or feel modern, users may not even complete the account registration process, leading to dropped conversions and a direct loss of revenue for financial apps.

3. Customer Support Costs Rise

Have you noticed more support tickets? A clunky or unintuitive UX could be the reason. Poor design leads to user confusion and more hand-holding for your support team. Resources are diverted and operational costs go up.

4. Missed Opportunities for Innovation

Fintech is all about innovation and legacy UIs can hold you back. Features like AI-powered financial advice, gamified saving tools, or real-time spending insights require modern interface capabilities that outdated designs often can’t support, putting your fintech product at a competitive disadvantage. Investing in a custom fintech solution can support these innovative features, providing the flexibility and scalability needed to stay ahead in the fast-moving fintech space.

5. Competitive Disadvantage

In the fintech industry, a competitive disadvantage can arise when a company fails to prioritize user experience (UX) design. A poorly designed fintech app or website can lead to a negative user experience, resulting in a loss of customers and revenue. In contrast, fintech companies that invest in UX design can gain a competitive advantage by providing a seamless and intuitive user experience that sets them apart from their competitors.

Think of sleek competitors like Chime, Revolut, or Robinhood. Their modern interfaces aren’t just pretty—they’re designed to increase engagement and trust. Falling behind on UI design can make your brand look outdated compared to up-and-coming competitors. Investing in a modern, user-friendly interface is not just about aesthetics; it’s about staying relevant and competitive in a fast-paced market.

The Importance of Fintech UX Design

Fintech UX design is crucial for fintech companies to succeed in today’s digital age. A well-designed fintech app or website can help users make informed financial decisions, manage their finances effectively, and build trust with the company. Managing finance can be a daunting task for many individuals, and a user-friendly design can make it more accessible and enjoyable. On the other hand, a poorly designed fintech app or website can lead to user frustration, confusion, and ultimately, a loss of business.

In the finance industry, where trust and reliability are paramount, a seamless user experience can be a significant differentiator. Users are more likely to stick with a platform that is intuitive, easy to navigate, and provides clear, actionable insights. By prioritizing fintech UX design, companies can enhance user satisfaction, reduce churn, and foster long-term loyalty. Tailored financial solutions, which require substantial investments and integrations, are essential for developing robust financial software that meets varying user needs.

Competitive Disadvantage in Fintech Apps: Think of sleek competitors like Chime, Revolut, or Robinhood. Their modern interfaces aren’t just pretty—they’re designed to increase engagement and trust. Falling behind on UI design can make your brand look outdated compared to up-and-coming competitors.

Building a Compliant Fintech Platform

Creating a compliant fintech platform is essential for financial institutions and startups aiming to offer financial services to their customers. Compliance involves adhering to various financial regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements. Additionally, it is crucial to ensure the security and integrity of financial data through technologies like data encryption and secure authentication. A fintech software development company can assist businesses in building a compliant fintech platform by providing expert guidance on regulatory compliance, security, and data protection. By developing a compliant fintech platform, businesses can mitigate the risk of non-compliance, safeguard their customers’ financial data, and deliver reliable financial services.

Current Challenges in Fintech UX Design

Fintech UX design is a complex and rapidly evolving field, with several challenges that designers must navigate. Some of the current challenges in fintech UX design include:

- Balancing Complexity and Simplicity: Fintech apps often require complex functionality, but users expect a simple and intuitive experience. Designers must balance these competing demands to create an app that is both functional and user-friendly.

- Ensuring Compliance: Fintech apps must comply with a range of regulatory requirements, including data protection and anti-money laundering laws. Designers must ensure that their apps meet these requirements, while also providing a seamless user experience.

- Managing User Anxiety: Fintech apps often involve sensitive financial information, which can create user anxiety. Designers must create an app that is transparent, trustworthy, and easy to use, to reduce user anxiety and increase engagement.

- Keeping Up with Changing User Behavior: User behavior is constantly evolving, and fintech designers must stay ahead of these changes to create an app that meets user needs. This includes incorporating the latest fintech UX design trends, such as data visualization and gamification.

By understanding these challenges, fintech designers can create apps that meet the evolving needs of their customers, while also ensuring compliance and reducing user anxiety.

Understanding the unique hurdles financial institutions and fintech companies face in creating user-friendly and compliant interfaces.

Competitive Disadvantage in Fintech Apps: Think of sleek competitors like Chime, Revolut or Robinhood. Their modern interfaces aren’t just pretty— they’re designed to increase engagement and trust. Falling behind on UI design can make your brand look outdated compared to up-and-coming competitors.

Signs Your Fintech UX Needs a Redesign

Not sure if your platform’s UI is due for a refresh? Here are some telltale signs:

- Outdated Aesthetic: If your app’s design hasn’t been updated in over 3 years, it looks dated compared to competitors.

- Clunky Navigation: Users report difficulty finding features or onboarding is too long.

- High Drop-off Rates: Analytics show users are abandoning the app at registration or checkout.

- Frequent Customer Complaints: Support tickets about confusing navigation, unclear buttons or feature instructions.

- Slow Response Times: Your UI isn’t optimized for modern browsers or mobile devices, causing lag and frustration.

Seen one or more of these? It’s time to redesign.

How to Fix Your Outdated Fintech UI

Fixing an outdated fintech UI doesn’t have to be overwhelming. Here’s a step by step approach to get your product back on track:

Step 1: Audit Your Current UI

Start by gathering data to understand what’s working and what’s not. Tools like Hotjar and FullStory can help you track user behavior to find pain points like navigation issues or drop-off locations. User surveys and interviews are also helpful to get direct feedback about your platform.

Goal: Understand the root causes of your UI problems.

Step 2: Benchmark Against Competitors

Look at how other fintech companies design their interfaces. For instance, SoFi offers various financial products alongside a user-friendly website design, catering to potential customers looking for trust and reliability in online banking services. Apps like Nubank, Coinbase, or Venmo set a high bar for fintech apps design. Do a competitor analysis to see what features or workflows they use to improve usability and engagement.

Goal: Identify industry best practices and user expectations.

Step 3: Define Your UX Goals

Outline specific goals for your redesign. For example:

- Simplify the onboarding process to reduce registration time.

- Improve the mobile experience for on-the-go users.

- Add real-time insights or visual spend tracking.

Staying updated with fintech UX design trends is crucial to ensure your redesign meets user expectations and industry standards.

Having clear goals will help you prioritize feature updates and align your redesign with measurable success metrics.

Step 4: Invest in a UI/UX Design Team

To create a successful fintech app or website, it’s essential to invest in a UI/UX design team. A UI/UX design team can help fintech companies create a user-centered design that meets the needs and expectations of their target audience. By investing in a UI/UX design team, fintech companies can ensure that their app or website is intuitive, easy to use, and provides a seamless user experience.

Whether you go in-house or outsource, bring in experienced designers who have worked on fintech projects and understand compliance requirements like PCI DSS or GDPR. A professional design team, along with a dedicated development team, can conduct user research, create prototypes, and test designs to ensure the final product meets user needs and business goals. Including prototypes or mockups early in your process to test with users can provide valuable feedback and help refine the design before launch.

Key Principles of Fintech UX Design

There are several key principles of fintech UX design that fintech companies should follow to create a successful app or website. These principles include:

- Simple and Intuitive Design: Ensure the interface is easy to navigate and understand.

- Clear and Concise Language: Use straightforward language to communicate complex financial information.

- Easy Navigation and User Flow: Simplify the user journey to enhance the overall experience.

- Secure and Reliable Financial Operations: Build trust by ensuring all transactions are secure and reliable.

- Personalization and Customization: Offer personalized features and settings to cater to individual user preferences.

- Data Visualization and Insights: Use visual tools to help users understand their financial data and make informed decisions.

- One-Tap Payment Capabilities: Simplify transactions with easy-to-use payment options.

- Simple API Integrations: Enhance functionality with seamless API integrations.

- Data-Driven Personalization: Use data to tailor the user experience to individual needs.

- Gamification and Engagement: Incorporate gamified elements to increase user engagement and satisfaction.

- Enhancing Personal Finance Management: Design tools that simplify financial management and promote healthy financial behaviors.

By adhering to these principles, fintech companies can create a user experience that is not only functional but also enjoyable and engaging.

Fintech App Design Best Practices

To create a successful fintech app, a fintech app development company should follow established best practices in fintech app design. These practices help ensure the product is not only functional but also intuitive, secure, and enjoyable to use. Key principles include:

- Conducting User Research: Understand the needs and expectations of your target audience through surveys, interviews, and usability testing. Unlike traditional banking, fintech apps aim to provide innovative and user-friendly experiences that simplify financial management.

- Creating a User-Centered Design: Focus on the user’s needs and preferences to craft an engaging and intuitive interface.

- Using Clear and Concise Language: Communicate complex financial information in a straightforward and accessible way.

- Providing Easy Navigation and User Flow: Simplify the user journey to ensure effortless task completion.

- Ensuring Secure and Reliable Financial Operations: Build trust by securing all transactions and maintaining platform stability.

- Offering Personalization and Customization: Enhance the user experience by allowing users to tailor features and settings.

- Using Data Visualization and Insights: Present data in an actionable format that supports informed financial decisions.

- Providing One-Tap Payment Capabilities: Enable quick, seamless transactions with minimal user effort.

- Using Simple API Integrations: Boost functionality through seamless integration with third-party services.

- Using Data-Driven Personalization: Leverage behavioral insights to offer a personalized experience for each user.

- Incorporating Gamification and Engagement: Add interactive elements to boost engagement and long-term retention.

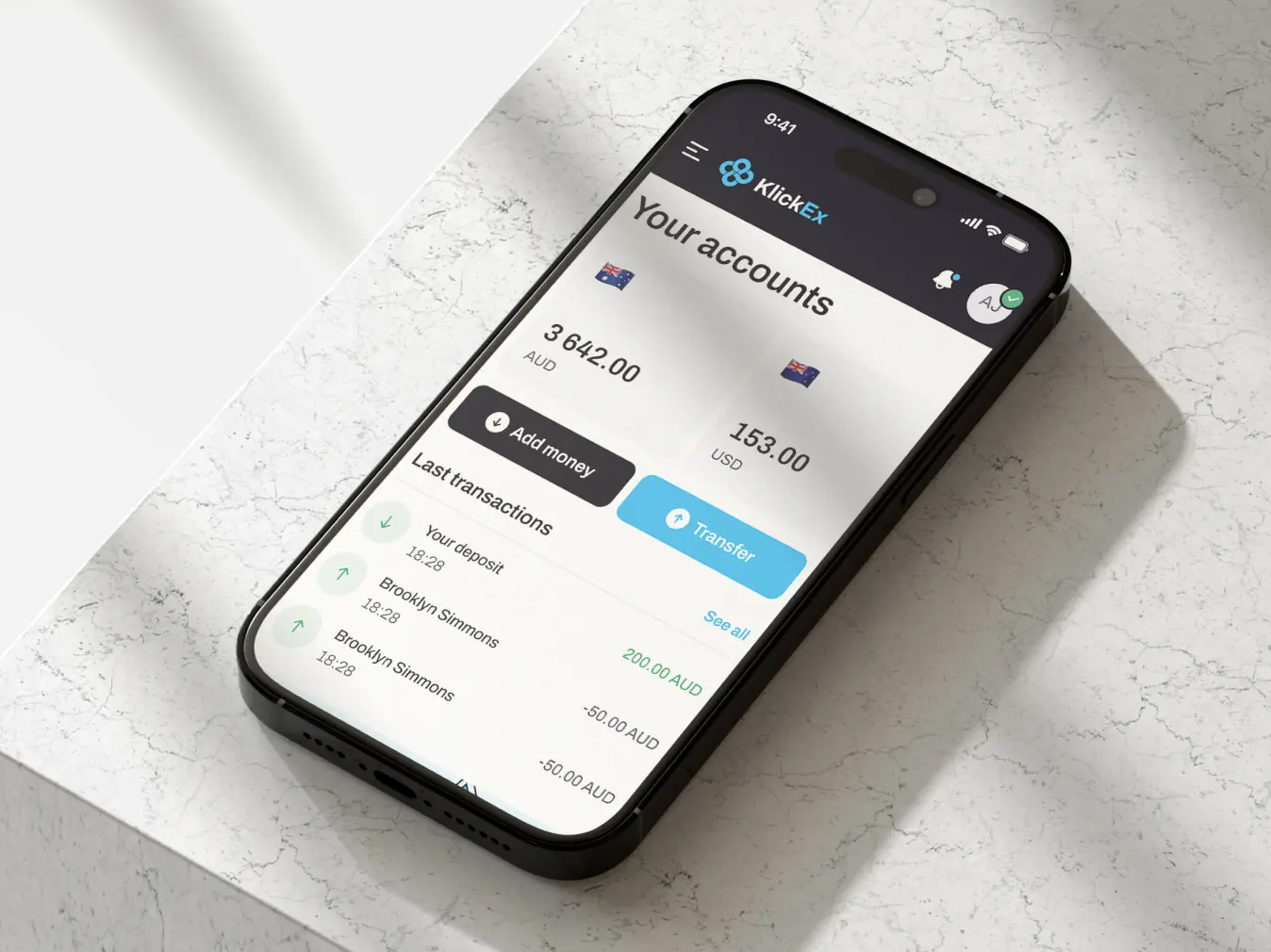

A great example of these best practices in action is our work on KlickEx, a cross-border fintech platform for Pacific Island communities. By conducting deep market research and focusing on a mobile-first design, we were able to:

- Streamline complex user flows — increasing key transaction conversions by over 30%

- Boost the “Add Money” flow by 35.3% and the “Money Transfer” flow by 30.7%

- Reach 53,000 active users, with a monthly growth of 3,000 new users

- Achieve a 54.8% completion rate on mobile, thanks to an interface optimized for real user behavior

- Enhance trust and security through robust authentication (Auth0 integration)

The KlickEx platform now serves as a vital financial bridge in the region, proving that user-centered design and strategic functionality can drive both engagement and growth.

By following these principles, fintech companies can build platforms that truly support users — helping them manage finances effectively and confidently.

Step 4: Invest in Fintech UX Designers: Whether you go in-house or outsource, bring in experienced designers who have worked on fintech projects and understand regulatory compliance requirements like PCI DSS or GDPR.

Pro Tip: Whether you go in-house or outsource, bring in experienced fintech UX designers who have worked on fintech projects and understand compliance requirements like PCI DSS or GDPR. Include prototypes or mockups early in your process to test with users.

Implement Customization, Personalization, and Data Visualization

Modern UI should cater to fintech app users’ preferences. Add:

- Dark mode & light mode options

- Personalized dashboards based on user activity

- Customizable alert settings

These small changes will make a big difference in user satisfaction and engagement.

Test, Iterate and Launch

Once your new UI is ready, test with beta users to catch usability issues or unexpected roadblocks. This is a crucial part of the development process, requiring a systematic approach to ensure quality and security. Gather data post-launch and iterate based on user feedback. UI/UX design is not a one-time task but an ongoing process to stay relevant.

Goal: Meet business KPIs and user satisfaction metrics.

Mobile App Development for Fintech

Mobile app development for fintech encompasses the design, development, and implementation of mobile apps for financial institutions, startups, and other organizations. These apps can offer a variety of financial services, including mobile banking, payment processing, and investment management. A fintech software development company can help businesses create mobile apps that are secure, user-friendly, and compliant with financial regulations. By utilizing cutting-edge technologies such as artificial intelligence, blockchain, and data analytics, mobile apps can provide innovative and efficient solutions for financial transactions, wealth management, and other financial activities. Through mobile app development for fintech, businesses can enhance their service offerings, improve customer experience, and stay competitive in the market.

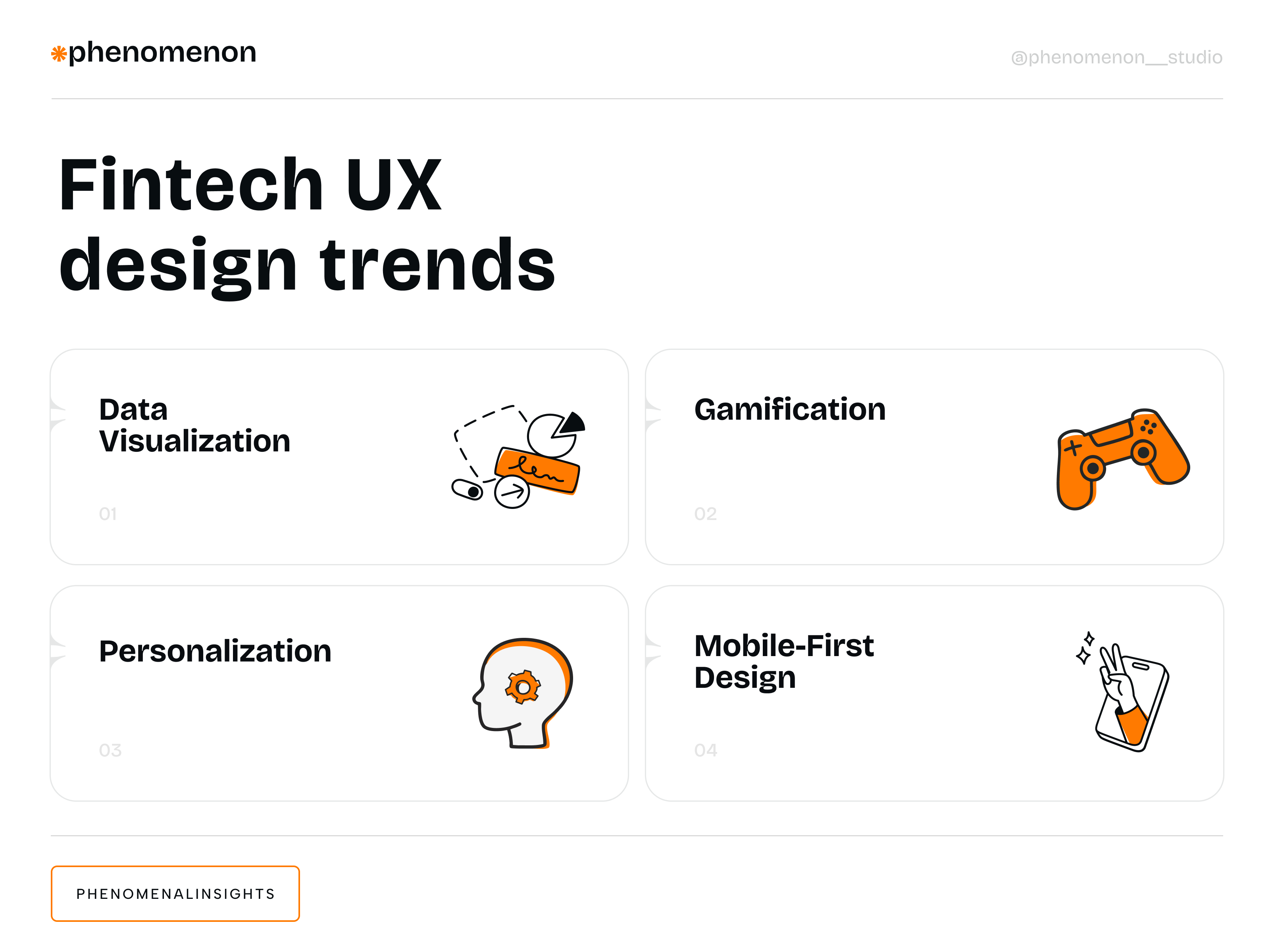

Fintech UX Design Trends

Fintech UX design is a rapidly evolving field, with new trends and technologies emerging all the time. Some of the latest fintech UX design trends include:

- Data Visualization: Data visualization is a key trend in fintech UX design, as it enables users to quickly and easily understand complex financial information. Designers are using a range of visualization techniques, including charts, graphs, and heat maps, to create interactive and engaging experiences.

- Gamification: Gamification is another key trend in fintech UX design, as it enables designers to create engaging and interactive experiences that encourage users to take action. Designers are using a range of gamification techniques, including rewards, challenges, and leaderboards, to create immersive experiences.

- Personalization: Personalization is a key trend in fintech UX design, as it enables designers to create experiences that are tailored to individual user needs. Designers are using a range of personalization techniques, including machine learning and data analytics, to create experiences that are relevant and engaging.

- Mobile-First Design: Mobile-first design is a key trend in fintech UX design, as it enables designers to create experiences that are optimized for mobile devices. Designers are using a range of mobile-first design techniques, including responsive design and mobile-specific features, to create experiences that are fast, intuitive, and engaging.

By incorporating these trends into their designs, fintech designers can create apps that are modern, user-friendly, and engaging, and that meet the evolving needs of their customers. Embracing digital transformation through these modern digital approaches ensures that financial services are not only efficient but also innovative and adaptive to new technologies.

Explore the latest trends shaping the future of fintech UX design, including mobile banking apps.

The ROI of a Modern Fintech UI

A modern UI doesn’t just fix immediate problems – it pays dividends:

- Reduced Churn: A modern banking app design keeps users engaged for longer.

- Higher Conversions: First impressions convert trial users to paying customers.

- Operational Savings: Fewer usability issues means less burden on your support team.

- Brand Differentiation: Stand out in a crowded market with a seamless experience.

- Scalability: A new UI infrastructure makes future innovations easier to implement.

The improved user experience combined with operational efficiency will strengthen your competitive edge and bottom line.

Get Started Today

An outdated fintech UI is more than just a cosmetic issue – it’s a hidden cost that can hinder growth, drain resources and frustrate users. But with a strategic redesign you can transform your user experience, improve engagement and unlock value for your customers and your business.

Need help with your fintech UI challenges? Contact a trusted design partner to help you design an interface for your audience and business goals.

Time to move your fintech platform forward.